Kroger 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-8

to Kroger’s charitable foundation will enable it to continue to support causes such as hunger relief, breast

cancer awareness, the military and their families and local community organizations. Our net earnings for

2013 include a net benefit of $23 million, which includes benefits from certain tax items of $40 million, offset

partially by costs of $11 million in interest and $16 million in OG&A expenses ($17 million after-tax) related

to our merger with Harris Teeter (“2013 Adjusted Items”).

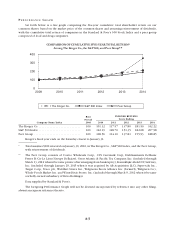

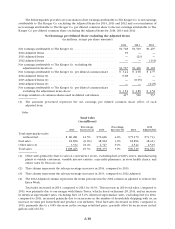

Excluding the 2014 Adjusted Items, net earnings for 2014 totaled $1.8 billion, or $3.52 per diluted share,

compared to net earnings in 2013 of $1.5 billion, or $2.85 per diluted share, excluding the 2013 Adjusted

Items. We believe adjusted net earnings and adjusted net earnings per diluted share present a more accurate

year-over-year comparison of our financial results because the Adjusted Items were not the result of our

normal operations. Our adjusted net earnings per diluted share for 2014 represent a 24% increase, compared

to 2013. Please refer to the “Net Earnings” section of MD&A for more information.

Our identical supermarket sales increased 5.2%, excluding fuel, in 2014, compared to 2013. We have

achieved 45 consecutive quarters of positive identical supermarket sales growth, excluding fuel. As we

continue to outpace many of our competitors on identical supermarket sales growth, we continue to gain

market share. We focus on identical supermarket sales growth, excluding fuel, as it is a key performance target

for our long-term growth strategy.

Increasing market share is an important part of our long-term strategy as it best reflects how our products

and services resonate with customers. Market share growth allows us to spread the fixed costs in our business

over a wider revenue base. Our fundamental operating philosophy is to maintain and increase market share

by offering customers good prices and superior products and service. Based on Nielsen POS+ data, our overall

market share of the products we sell in markets in which we operate increased by approximately 60 basis

points in 2014. This data also indicates that our market share increased in 18 markets and declined slightly in

two. Wal-Mart is one of our top two competitors in 15 of the 20 markets outlined in the Nielson report. Our

market share increased in all 15 of these markets. These market share results reflect our long-term strategy of

market share growth.

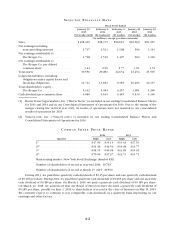

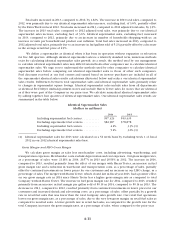

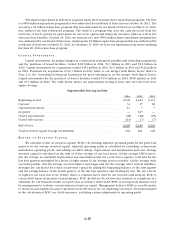

RE S U L T S O F O P E R A T I O N S

The following discussion summarizes our operating results for 2014 compared to 2013 and for 2013

compared to 2012. Comparability is affected by income and expense items that fluctuated significantly

between and among the periods, our merger with Harris Teeter in late 2013 and an extra week in 2012.

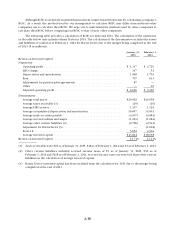

Net Earnings

Net earnings totaled $1.7 billion in 2014 and $1.5 billion in 2013 and 2012. Net earnings improved in

2014, compared to net earnings in 2013, due to an increase in operating profit, partially offset by increases in

interest and tax expense. Operating profit increased in 2014, compared to 2013, primarily due to an increase

in first-in, first-out (“FIFO”) non-fuel gross profit, excluding Harris Teeter, the effect of our merger with Harris

Teeter and an increase in fuel operating profit, partially offset by continued investments in lower prices for

our customers, the 2014 Contributions, an $87 million ($56 million after-tax) charge due to the restructuring

of certain pension plan agreements and a higher LIFO charge which was $147 million (pre-tax), compared

to a LIFO charge of $52 million (pre-tax) in 2013. Net earnings improved in 2013, compared to net earnings

of 2012, due to a decrease in tax and interest expense, partially offset by a decrease in operating profit.

Operating profit decreased in 2013, compared to 2012, primarily due to a 53rd week in fiscal year 2012 (the

“Extra Week”), continued investments in lower prices for our customers, the 2012 settlement with Visa and

MasterCard and the reduction in our obligation to fund the UFCW Consolidated Pension Plan created in 2012,

partially offset by an increase in FIFO non-fuel gross profit.

The net earnings for 2014 include a net charge of $39 million, after tax, related to the 2014 Adjusted Items.

The net earnings for 2013 include a net benefit of $23 million, after tax, related to the 2013 Adjusted Items.

The net earnings for 2012 include a benefit from net earnings of approximately $58 million, after-tax, due to

the Extra Week and a net $115 million ($74 million after-tax) benefit in OG&A expenses for the settlement

with Visa and MasterCard and a reduction in our obligation to fund the UFCW Consolidated Pension Plan