Kroger 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-55

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

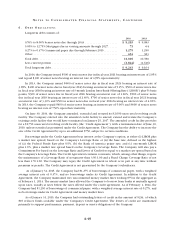

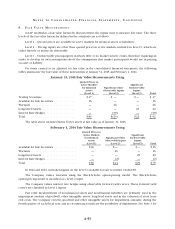

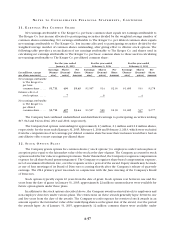

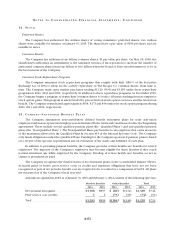

9 . A C C U M U L A T E D O T H E R C O M P R E H E N S I V E I N C O M E ( L O S S )

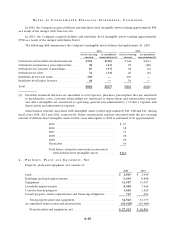

The following table represents the changes in AOCI by component for the years ended February 1, 2014

and January 31, 2015:

Cash Flow

Hedging

Activities (1)

Available

for sale

Securities (1)

Pension and

Postretirement

Defined Benefit

Plans (1) Total (1)

Balance at February 2, 2013 . . . . . . . . . . . . . . . . . . $ (14) $ 7 $(746) $(753)

OCI before reclassifications (2) . . . . . . . . . . . . . . . (12) 5 233 226

Amounts reclassified out of AOCI (3) . . . . . . . . . . . 1 — 62 63

Net current-period OCI . . . . . . . . . . . . . . . . . . . . . . (11) 5 295 289

Balance at February 1, 2014 . . . . . . . . . . . . . . . . . . (25) 12 (451) (464)

OCI before reclassifications (2) . . . . . . . . . . . . . . . (25) 5 (351) (371)

Amounts reclassified out of AOCI (3) . . . . . . . . . . . 1 — 22 23

Net current-period OCI . . . . . . . . . . . . . . . . . . . . . . (24) 5 (329) (348)

Balance at January 31, 2015 . . . . . . . . . . . . . . . . . . . $(49) $17 $(780) $(812)

(1) All amounts are net of tax.

(2) Net of tax of $(8), $3 and $137 for cash flow hedging activities, available for sale securities and pension

and postretirement defined benefit plans, respectively, as of February 1, 2014. Net of tax of $(14), $3

and $(206) for cash flow hedging activities, available for sale securities and pension and postretirement

defined benefit plans, respectively, as of January 31, 2015.

(3) Net of tax of $1 and $36 for cash flow hedging activities and pension and postretirement defined benefit

plans, respectively, as of February 1, 2014. Net of tax of $13 for pension and postretirement defined

benefit plans, as of January 31, 2015.

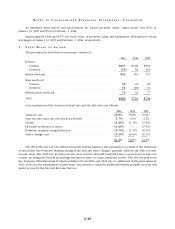

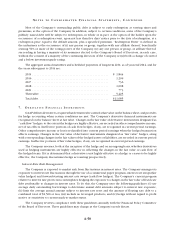

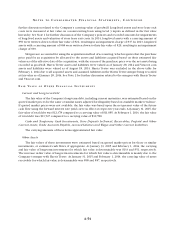

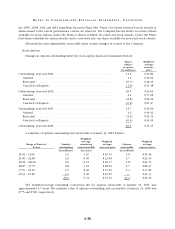

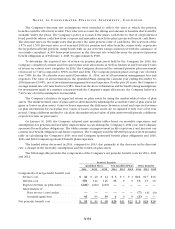

The following table represents the items reclassified out of AOCI and the related tax effects for the year

ended January 31, 2015 and February 1, 2014:

For the year ended

January 31, 2015

For the year ended

February 1, 2014

Gains on cash flow hedging activities

Amortization of unrealized gains and losses on

cash flow hedging activities (1) . . . . . . . . . . . . . . . . . . . . . . . $ 1 $ 2

Tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (1)

Net of tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1

Pension and postretirement defined benefit plan items

Amortization of amounts included in net periodic

pension expense (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 98

Tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13) (36)

Net of tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 62

Total reclassifications, net of tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23 $ 63

(1) Reclassified from AOCI into interest expense.

(2) Reclassified from AOCI into merchandise costs and OG&A expense. These components are included in

the computation of net periodic pension costs (see Note 15 for additional details).