Kroger 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-67

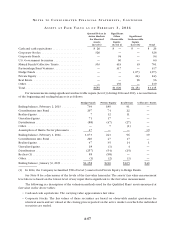

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

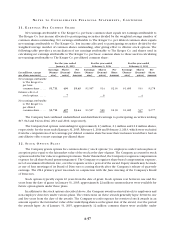

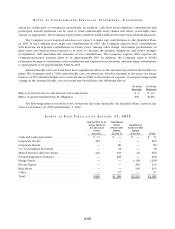

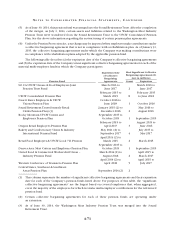

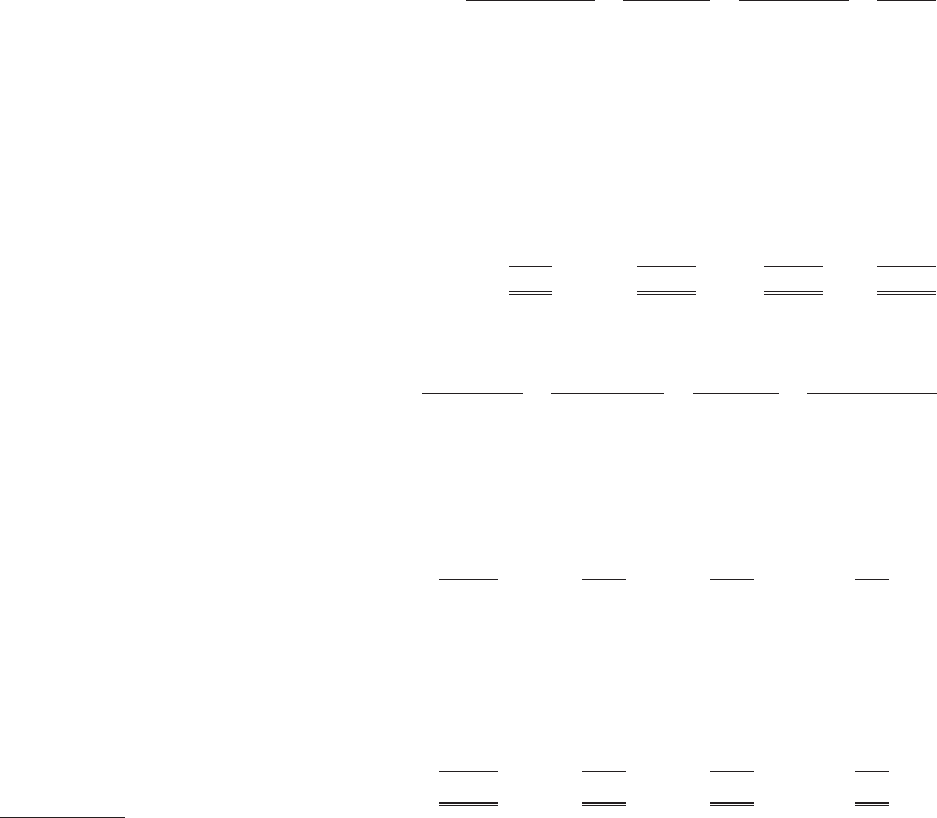

AS S E T S A T F A I R VA L U E A S O F F E B R U A R Y 1 , 2 0 14

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . $ 26 $ — $ — $ 26

Corporate Stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . 326 — — 326

Corporate Bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . — 94 — 94

U.S. Government Securities . . . . . . . . . . . . . . . . . . — 60 — 60

Mutual Funds/Collective Trusts . . . . . . . . . . . . . . . 303 419 39 761

Partnerships/Joint Ventures . . . . . . . . . . . . . . . . . . — 317 — 317

Hedge Funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1,073 1,073

Private Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 243 243

Real Estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 96 96

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 139 — 139

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $655 $1,029 $1,451 $3,135

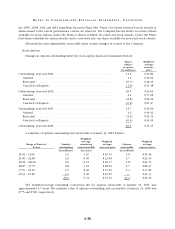

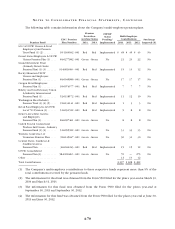

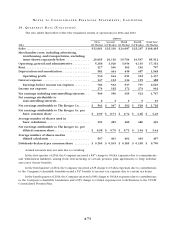

For measurements using significant unobservable inputs (Level 3) during 2014 and 2013, a reconciliation

of the beginning and ending balances is as follows:

Hedge Funds Private Equity Real Estate Collective Trusts

Ending balance, February 2, 2013 . . . . . . . . . 739 180 91 —

Contributions into Fund . . . . . . . . . . . . . . . . . 297 74 22 —

Realized gains . . . . . . . . . . . . . . . . . . . . . . . . . 7 12 11 —

Unrealized gains . . . . . . . . . . . . . . . . . . . . . . . 71 17 — —

Distributions . . . . . . . . . . . . . . . . . . . . . . . . . . (88) (47) (27) —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 7 (1) —

Assumption of Harris Teeter plan assets . . . . 47 — — 39

Ending balance, February 1, 2014 . . . . . . . . . . 1,073 243 96 39

Contributions into Fund . . . . . . . . . . . . . . . . . 220 47 17 —

Realized gains . . . . . . . . . . . . . . . . . . . . . . . . . 47 35 14 1

Unrealized gains . . . . . . . . . . . . . . . . . . . . . . . 18 (1) 4 —

Distributions . . . . . . . . . . . . . . . . . . . . . . . . . . (257) (54) (25) —

Reclass (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58 (58) — —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) (2) (1) —

Ending balance, January 31, 2015 . . . . . . . . . . $1,158 $210 $105 $40

(1) In 2014, the Company reclassified $58 of Level 3 assets from Private Equity to Hedge Funds.

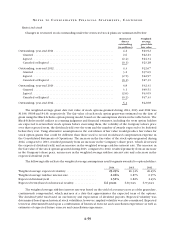

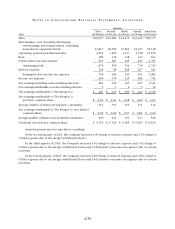

See Note 8 for a discussion of the levels of the fair value hierarchy. The assets’ fair value measurement

level above is based on the lowest level of any input that is significant to the fair value measurement.

The following is a description of the valuation methods used for the Qualified Plans’ assets measured at

fair value in the above tables:

• Cashandcashequivalents:Thecarryingvalueapproximatesfairvalue.

• Corporate Stocks: The fair values of these securities are based on observable market quotations for

identical assets and are valued at the closing price reported on the active market on which the individual

securities are traded.