Kroger 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-42

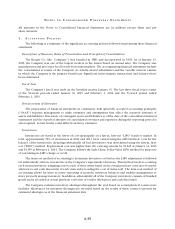

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

assets or liabilities that require recognition in connection with the application of acquisition accounting under

Accounting Standards Codification (“ASC”) 805. Intangible assets are recognized apart from goodwill when

the asset arises from contractual or other legal rights, or are separable from the acquired entity such that they

may be sold, transferred, licensed, rented or exchanged either on a standalone basis or in combination with

a related contract, asset or liability.

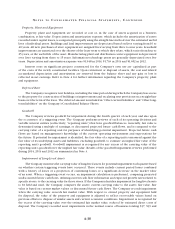

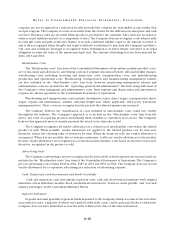

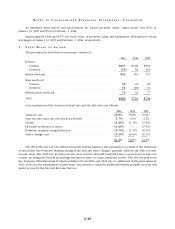

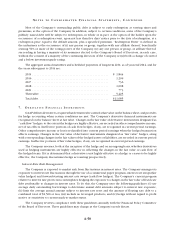

Pending finalization of the Company’s valuation and other items, the following table summarizes the

preliminary fair values of the assets acquired and liabilities assumed as part of the merger with Vitacost.com:

August 18,

2014

ASSETS

Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 79

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

Total Assets, excluding Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 188

LIABILITIES

Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (54)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7)

Total Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (61)

Total Identifiable Net Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 127

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160

Total Purchase Price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $287

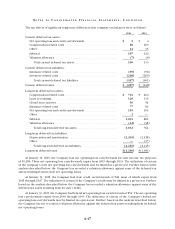

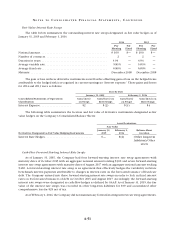

Of the $81 allocated to intangible assets, the Company recorded $49, $26 and $6 related to customer

relationships, technology and the trade name, respectively. The Company will amortize the technology and

the trade name, using the straight line method, over 10 and three years, respectively, while the customer

relationships will be amortized over five years using the declining balance method. The goodwill recorded

as part of the merger was attributable to the assembled workforce of Vitacost.com and operational synergies

expected from the merger, as well as any intangible assets that did not qualify for separate recognition.

The transaction was treated as a stock purchase for income tax purposes. The assets acquired and liabilities

assumed as part of the merger did not result in a step up of the tax basis and goodwill is not expected to be

deductible for tax purposes. The above amounts represent the preliminary allocation of the purchase price,

and are subject to revision when the resulting valuations of property and intangible assets are finalized, which

will occur prior to August 18, 2015. The results of operations of Vitacost.com were not material in 2014.

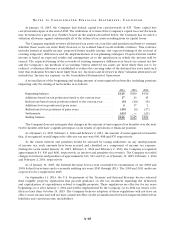

On January 28, 2014, the Company closed its merger with Harris Teeter by purchasing 100% of the

Harris Teeter outstanding common stock for $2,436. The merger allows us to expand into the fast-growing

southeastern and mid-Atlantic markets and into Washington, D.C. The merger was accounted for under the

purchase method of accounting and was financed through a combination of commercial paper and long-term

debt (see Note 6).

The fair value step up adjustment to Harris Teeter inventory as of the merger date is recorded in the LIFO

reserve. This resulted in a $52 decrease in LIFO reserve.