Kroger 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-16

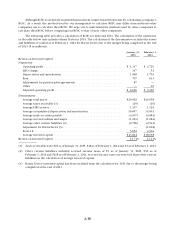

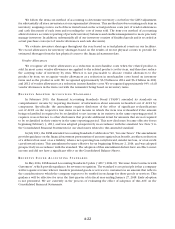

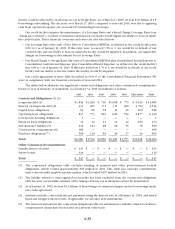

Although ROIC is a relatively standard financial term, numerous methods exist for calculating a company’s

ROIC. As a result, the method used by our management to calculate ROIC may differ from methods other

companies use to calculate their ROIC. We urge you to understand the methods used by other companies to

calculate their ROIC before comparing our ROIC to that of such other companies.

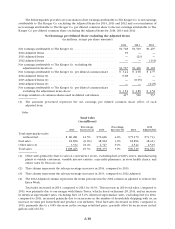

The following table provides a calculation of ROIC for 2014 and 2013. The calculation of the numerator

in the table below only includes Harris Teeter in 2014. The calculation of the denominator excludes the assets

and liabilities recorded as of February 1, 2014 for Harris Teeter due to the merger being completed at the end

of 2013 ($ in millions):

January 31,

2015

February 1,

2014

Return on Invested Capital

Numerator

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,137 $ 2,725

LIFO charge. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147 52

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,948 1,703

Rent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 707 613

Adjustments for pension plan agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87 —

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 16

Adjusted operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,026 $ 5,109

Denominator

Average total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $29,919 $26,958

Average taxes receivable (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (19) (10)

Average LIFO reserve . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,197 1,124

Average accumulated depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . 16,057 14,991

Average trade accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,967) (4,683)

Average accrued salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,221) (1,084)

Average other current liabilities (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,780) (2,544)

Adjustment for Harris Teeter (3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (1,618)

Rent x 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,656 4,904

Average invested capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $43,842 $38,038

Return on Invested Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.74% 13.43%

(1) Taxes receivable were $20 as of January 31, 2015, $18 as of February 1, 2014 and $2 as of February 2, 2013.

(2) Other current liabilities included accrued income taxes of $5 as of January 31, 2015, $92 as of

February 1, 2014 and $128 as of February 2, 2013. Accrued income taxes are removed from other current

liabilities in the calculation of average invested capital.

(3) Harris Teeter’s invested capital has been excluded from the calculation for 2013 due to the merger being

completed at the end of 2013.