Kroger 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-37

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

$18 in 2014, 2013 and 2012, respectively. Costs to reduce the carrying value of long-lived assets for each of the

years presented have been included in the Consolidated Statements of Operations as “Operating, general and

administrative” expense.

Store Closing Costs

The Company provides for closed store liabilities relating to the present value of the estimated remaining

non-cancellable lease payments after the closing date, net of estimated subtenant income. The Company

estimates the net lease liabilities using a discount rate to calculate the present value of the remaining net rent

payments on closed stores. The closed store lease liabilities usually are paid over the lease terms associated

with the closed stores, which generally have remaining terms ranging from one to 20 years. Adjustments to

closed store liabilities primarily relate to changes in subtenant income and actual exit costs differing from

original estimates. Adjustments are made for changes in estimates in the period in which the change becomes

known. Store closing liabilities are reviewed quarterly to ensure that any accrued amount that is not a sufficient

estimate of future costs is adjusted to income in the proper period.

Owned stores held for disposal are reduced to their estimated net realizable value. Costs to reduce the

carrying values of property, equipment and leasehold improvements are accounted for in accordance with the

Company’s policy on impairment of long-lived assets. Inventory write-downs, if any, in connection with store

closings, are classified in the Consolidated Statements of Operations as “Merchandise costs.” Costs to transfer

inventory and equipment from closed stores are expensed as incurred.

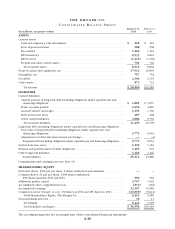

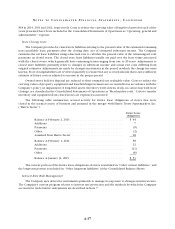

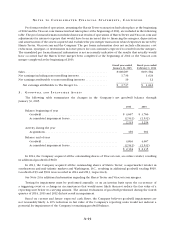

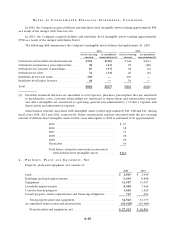

The following table summarizes accrual activity for future lease obligations of stores that were

closed in the normal course of business and assumed in the merger with Harris Teeter Supermarkets, Inc.

(“Harris Teeter”):

Future Lease

Obligations

Balance at February 2, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 44

Additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2)

Assumed from Harris Teeter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Balance at February 1, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

Additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6)

Balance at January 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 53

The current portion of the future lease obligations of stores is included in “Other current liabilities,” and

the long-term portion is included in “Other long-term liabilities” in the Consolidated Balance Sheets.

Interest Rate Risk Management

The Company uses derivative instruments primarily to manage its exposure to changes in interest rates.

The Company’s current program relative to interest rate protection and the methods by which the Company

accounts for its derivative instruments are described in Note 7.