Kroger 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

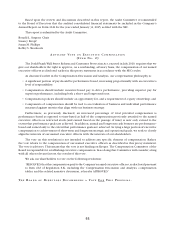

A-2

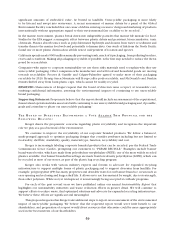

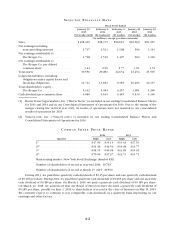

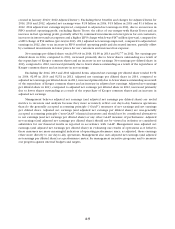

SE L E C T E D F I N A N C I A L D A T A

Fiscal Years Ended

January 31,

2015

(52 weeks) (1)(2)

February 1,

2014

(52 weeks) (1)

February 2,

2013

(53 weeks)

January 28,

2012

(52 weeks)

January 29,

2011

(52 weeks)

(In millions, except per share amounts)

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $108,465 $98,375 $96,619 $90,269 $81,967

Net earnings including

noncontrolling interests . . . . . . . . . . . . 1,747 1,531 1,508 596 1,133

Net earnings attributable to

The Kroger Co. . . . . . . . . . . . . . . . . . . . 1,728 1,519 1,497 602 1,116

Net earnings attributable to

The Kroger Co. per diluted

common share . . . . . . . . . . . . . . . . . . . . 3.44 2.90 2.77 1.01 1.74

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . 30,556 29,281 24,634 23,454 23,505

Long-term liabilities, including

obligations under capital leases and

financing obligations . . . . . . . . . . . . . . . 13,711 13,181 9,359 10,405 10,137

Total shareholders’ equity –

The Kroger Co. . . . . . . . . . . . . . . . . . . . 5,412 5,384 4,207 3,981 5,296

Cash dividends per common share . . . . . . 0.680 0.615 0.495 0.430 0.390

(1) Harris Teeter Supermarkets, Inc. (“Harris Teeter”) is included in our ending Consolidated Balance Sheets

for 2013 and 2014 and in our Consolidated Statements of Operations for 2014. Due to the timing of the

merger closing late in fiscal year 2013, its results of operations were not material to our consolidated

results of operations for 2013.

(2) Vitacost.com, Inc. (“Vitacost.com”) is included in our ending Consolidated Balance Sheets and

Consolidated Statements of Operations for 2014.

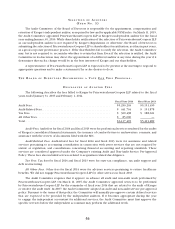

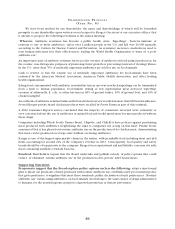

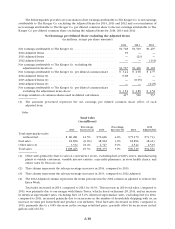

CO M M O N S H A R E P R I C E R A N G E

2014 2013

Quarter High Low High Low

1st . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $47.90 $35.13 $35.44 $27.53

2nd . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $51.49 $46.50 $39.98 $32.77

3rd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $58.15 $49.98 $43.85 $35.91

4th . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $70.06 $57.27 $42.73 $35.71

Main trading market: New York Stock Exchange (Symbol KR)

Number of shareholders of record at year-end 2014: 29,792

Number of shareholders of record at March 27, 2015: 29,502

During 2013, we paid three quarterly cash dividends of $0.15 per share and one quarterly cash dividend

of $0.165 per share. During 2014, we paid three quarterly cash dividends of $0.165 per share and one quarterly

cash dividend of $0.185 per share. On March 1, 2015, we paid a quarterly cash dividend of $0.185 per share.

On March 12, 2015, we announced that our Board of Directors have declared a quarterly cash dividend of

$0.185 per share, payable on June 1, 2015, to shareholders of record at the close of business on May 15, 2015.

We currently expect to continue to pay comparable cash dividends on a quarterly basis depending on our

earnings and other factors.