Kroger 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-52

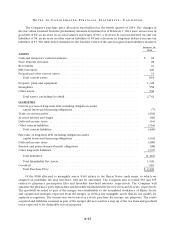

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

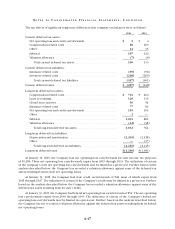

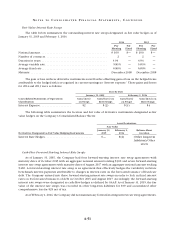

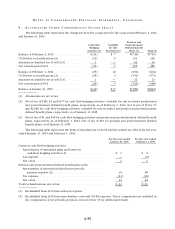

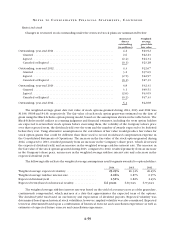

The following table summarizes the effect of the Company’s derivative instruments designated as cash

flow hedges for 2014 and 2013:

Year-To-Date

Derivatives in Cash Flow Hedging

Relationships

Amount of Gain/(Loss)

in AOCI on Derivative

(Effective Portion)

Amount of Gain/

(Loss) Reclassified

from AOCI into Income

(Effective Portion)

Location of Gain/(Loss)

Reclassified into Income

(Effective Portion)2014 2013 2014 2013

Forward-Starting Interest Rate

Swaps, net of tax* . . . . . . . . . $(49) $(25) $(1) $(1) Interest expense

* The amounts of Gain/(Loss) in AOCI on derivatives include unamortized proceeds and payments from

forward-starting interest rate swaps once classified as cash flow hedges that were terminated prior to

end of 2014.

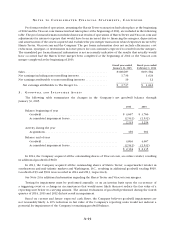

For the above fair value and cash flow interest rate swaps, the Company has entered into International

Swaps and Derivatives Association master netting agreements that permit the net settlement of amounts owed

under their respective derivative contracts. Under these master netting agreements, net settlement generally

permits the Company or the counterparty to determine the net amount payable for contracts due on the same

date and in the same currency for similar types of derivative transactions. These master netting agreements

generally also provide for net settlement of all outstanding contracts with a counterparty in the case of an

event of default or a termination event.

Collateral is generally not required of the counterparties or of the Company under these master netting

agreements. As of January 31, 2015 and February 1, 2014, no cash collateral was received or pledged under the

master netting agreements.

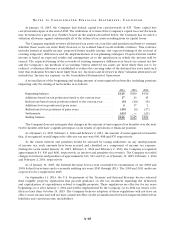

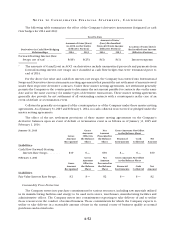

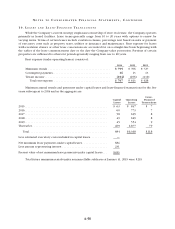

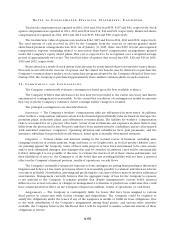

The effect of the net settlement provisions of these master netting agreements on the Company’s

derivative balances upon an event of default or termination event is as follows as of January 31, 2015 and

February 1, 2014:

January 31, 2015

Gross

Amount

Recognized

Gross

Amounts

Offset in

the Balance

Sheet

Net

Amount

Presented in

the Balance

Sheet

Gross Amounts Not Offset

in the Balance Sheet

Net

Amount

Financial

Instruments

Cash

Collateral

Liabilities

Cash Flow Forward-Starting

Interest Rate Swaps . . . . . . . . $39 $— $39 $— $— $39

February 1, 2014

Gross

Amount

Recognized

Gross

Amounts

Offset in

the Balance

Sheet

Net

Amount

Presented in

the Balance

Sheet

Gross Amounts Not Offset

in the Balance Sheet

Net

Amount

Financial

Instruments

Cash

Collateral

Liabilities

Fair Value Interest Rate Swaps . . . $2 $— $2 $— $— $2

Commodity Price Protection

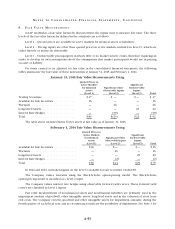

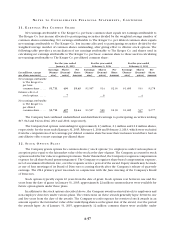

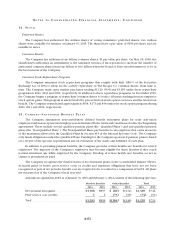

The Company enters into purchase commitments for various resources, including raw materials utilized

in its manufacturing facilities and energy to be used in its stores, warehouses, manufacturing facilities and

administrative offices. The Company enters into commitments expecting to take delivery of and to utilize

those resources in the conduct of normal business. Those commitments for which the Company expects to

utilize or take delivery in a reasonable amount of time in the normal course of business qualify as normal

purchases and normal sales.