Kroger 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-46

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

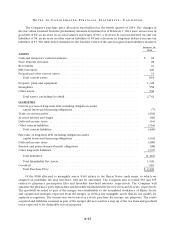

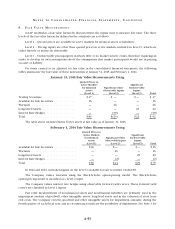

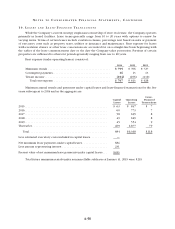

Accumulated depreciation and amortization for leased property under capital leases was $332 at

January 31, 2015 and $339 at February 1, 2014.

Approximately $260 and $175, net book value, of property, plant and equipment collateralized certain

mortgages at January 31, 2015 and February 1, 2014, respectively.

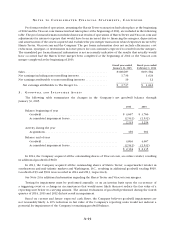

5 . T A X E S B A S E D O N I N C O M E

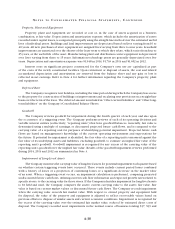

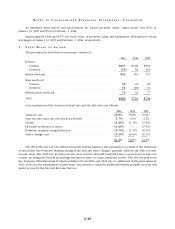

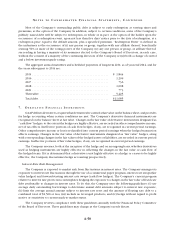

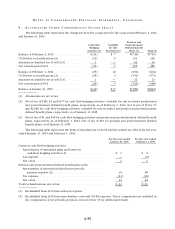

The provision for taxes based on income consists of:

2014 2013 2012

Federal

Current ................................................ $847 $638 $563

Deferred ............................................... (15) 81 154

Subtotal federal ............................................ 832 719 717

State and local

Current ................................................ 59 42 46

Deferred ............................................... 11 (10) 31

Subtotal state and local ...................................... 70 32 77

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $902 $751 $794

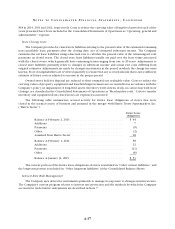

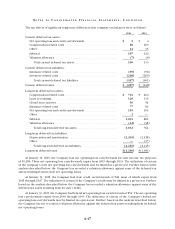

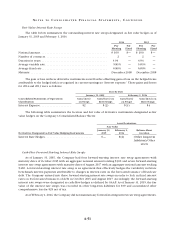

A reconciliation of the statutory federal rate and the effective rate follows:

2014 2013 2012

Statutory rate ........................................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit .................. 1.7% 0.9% 2.2%

Credits ................................................ (1.2)% (1.3)% (1.4)%

Favorable resolution of issues .............................. (0.4)% — (0.5)%

Domestic manufacturing deduction ......................... (0.7)% (1.1)% (0.5)%

Other changes, net....................................... (0.3)% (0.6)% (0.3)%

34.1% 32.9% 34.5%

The 2014 effective tax rate differed from the federal statutory rate primarily as a result of the utilization

of tax credits, the Domestic Manufacturing Deduction and other changes, partially offset by the effect of state

income taxes. The 2013 rate for state income taxes is lower than 2014 and 2012 due to an increase in state tax

credits, including the benefit from filing amended returns to claim additional credits. The 2013 benefit from

the Domestic Manufacturing Deduction differed from 2014 and 2012 due to additional deductions taken in

2013, as well as the amendment of prior years’ tax returns to claim the additional benefit available in years still

under review by the Internal Revenue Service.