Kroger 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-63

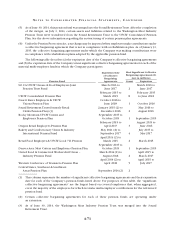

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

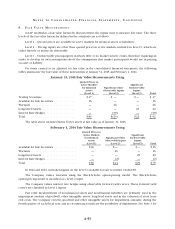

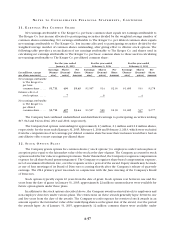

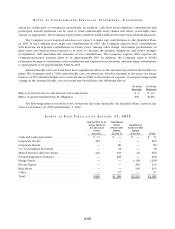

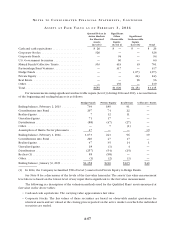

Information with respect to change in benefit obligation, change in plan assets, the funded status of

the plans recorded in the Consolidated Balance Sheets, net amounts recognized at the end of fiscal years,

weighted average assumptions and components of net periodic benefit cost follow:

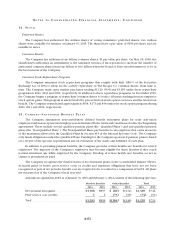

Pension Benefits

Qualified Plans Non-Qualified Plans Other Benefits

2014 2013 2014 2013 2014 2013

Change in benefit obligation:

Benefit obligation at beginning of fiscal year . . . . . . . $3,509 $3,443 $ 263 $ 221 $ 294 $ 402

Service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48 40 3 3 11 17

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 169 144 13 9 13 15

Plan participants’ contributions . . . . . . . . . . . . . . — — — — 11 10

Actuarial (gain) loss . . . . . . . . . . . . . . . . . . . . . . . . 539 (308) 40 (20) 14 (97)

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (163) (136) (15) (10) (21) (25)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ————(47) (30)

Assumption of Harris Teeter benefit obligation. . . . —326 —60 —2

Benefit obligation at end of fiscal year . . . . . . . . . . . . $4,102 $3,509 $ 304 $ 263 $ 275 $ 294

Change in plan assets:

Fair value of plan assets at beginning of

fiscal year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,135 $2,746 $ — $ — $ — $ —

Actual return on plan assets . . . . . . . . . . . . . . . . . 217 139 — — — —

Employer contributions . . . . . . . . . . . . . . . . . . . . . — 100 15 10 10 15

Plan participants’ contributions . . . . . . . . . . . . . . — — — — 11 10

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (163) (136) (15) (10) (21) (25)

Assumption of Harris Teeter plan assets . . . . . . . . —286 ————

Fair value of plan assets at end of fiscal year . . . . . . . $3,189 $3,135 $ — $ — $ — $ —

Funded status at end of fiscal year . . . . . . . . . . . . . . . $ (912) $ (374) $(304) $(263) $(275) $(294)

Net liability recognized at end of fiscal year . . . . . . . $ (912) $ (374) $(304) $(263) $(275) $(294)

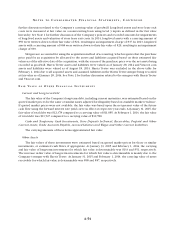

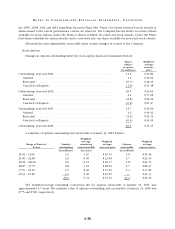

As of January 31, 2015 and February 1, 2014, other current liabilities include $28 and $30, respectively,

of net liability recognized for the above benefit plans.

The pension plan assets acquired and liabilities assumed in the Harris Teeter merger did not affect the

Company’s net periodic benefit costs in 2013 due to the merger occurring close to year end.

As of January 31, 2015 and February 1, 2014, pension plan assets do not include common shares of The

Kroger Co.

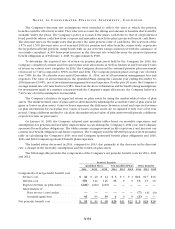

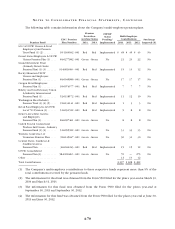

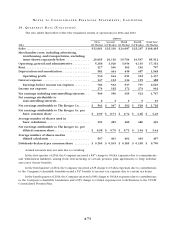

Pension Benefits Other Benefits

Weighted average assumptions 2014 2013 2012 2014 2013 2012

Discount rate – Benefit obligation . . . . . . . . . . . . . 3.87% 4.99% 4.29% 3.74% 4.68% 4.11%

Discount rate – Net periodic benefit cost . . . . . . . 4.99% 4.29% 4.55% 4.68% 4.11% 4.40%

Expected long-term rate of return on plan assets . . . 7.44% 8.50% 8.50%

Rate of compensation increase –

Net periodic benefit cost . . . . . . . . . . . . . . . . . . 2.86% 2.77% 2.82%

Rate of compensation increase –

Benefit obligation . . . . . . . . . . . . . . . . . . . . . . . 2.85% 2.86% 2.77%