Kroger 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-49

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

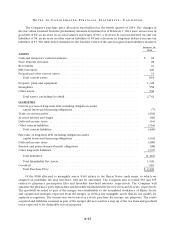

6 . D E B T O B L I G A T I O N S

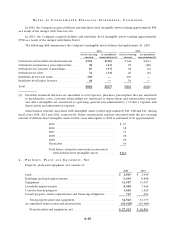

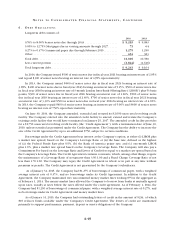

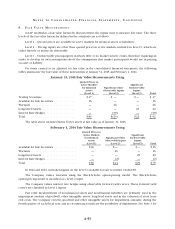

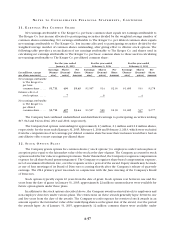

Long-term debt consists of:

2014 2013

0.76% to 8.00% Senior notes due through 2043 ..................... $ 9,283 $ 9,083

5.00% to 12.75% Mortgages due in varying amounts through 2027 ...... 73 64

0.27% to 0.37% Commercial paper due through February 2015 ......... 1,275 1,250

Other ...................................................... 454 383

Total debt ................................................... 11,085 10,780

Less current portion .......................................... (1,844) (1,616)

Total long-term debt........................................... $ 9,241 $ 9,164

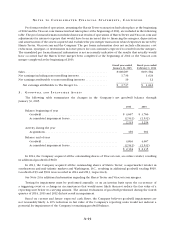

In 2014, the Company issued $500 of senior notes due in fiscal year 2021 bearing an interest rate of 2.95%

and repaid $300 of senior notes bearing an interest rate of 4.95% upon maturity.

In 2013, the Company issued $600 of senior notes due in fiscal year 2023 bearing an interest rate of

3.85%, $400 of senior notes due in fiscal year 2043 bearing an interest rate of 5.15%, $500 of senior notes due

in fiscal year 2016 bearing an interest rate of 3-month London Inter-Bank Offering Rate (“LIBOR”) plus 53 basis

points, $300 of senior notes due in fiscal year 2016 bearing an interest rate of 1.20%, $500 of senior notes

due in fiscal year 2019 bearing an interest rate of 2.30%, $700 of senior notes due in fiscal year 2021 bearing

an interest rate of 3.30% and $500 in senior notes due in fiscal year 2024 bearing an interest rate of 4.00%.

In 2013, the Company repaid $400 of senior notes bearing an interest rate of 5.00% and $600 of senior notes

bearing an interest rate of 7.50% upon their maturity.

On June 30, 2014, the Company amended, extended and restated its $2,000 unsecured revolving credit

facility. The Company entered into the amended credit facility to amend, extend and restate the Company’s

existing credit facility that would have terminated on January 25, 2017. The amended credit facility provides

for a $2,750 unsecured revolving credit facility (the “Credit Agreement”), with a termination date of June 30,

2019, unless extended as permitted under the Credit Agreement. The Company has the ability to increase the

size of the Credit Agreement by up to an additional $750, subject to certain conditions.

Borrowings under the Credit Agreement bear interest at the Company’s option, at either (i) LIBOR plus

a market rate spread, based on the Company’s Leverage Ratio or (ii) the base rate, defined as the highest

of (a) the Federal Funds Rate plus 0.5%, (b) the Bank of America prime rate, and (c) one-month LIBOR

plus 1.0%, plus a market rate spread based on the Company’s Leverage Ratio. The Company will also pay a

Commitment Fee based on the Leverage Ratio and Letter of Credit fees equal to a market rate spread based on

the Company’s Leverage Ratio. The Credit Agreement contains covenants, which, among other things, require

the maintenance of a Leverage Ratio of not greater than 3.50:1.00 and a Fixed Charge Coverage Ratio of not

less than 1.70:1.00. The Company may repay the Credit Agreement in whole or in part at any time without

premium or penalty. The Credit Agreement is not guaranteed by the Company’s subsidiaries.

As of January 31, 2015, the Company had $1,275 of borrowings of commercial paper, with a weighted

average interest rate of 0.37%, and no borrowings under its Credit Agreement. In addition to the Credit

Agreement, the Company maintained two uncommitted money market lines totaling $75 in the aggregate as

of February 1, 2014. The money market lines allowed the Company to borrow from banks at mutually agreed

upon rates, usually at rates below the rates offered under the credit agreement. As of February 1, 2014, the

Company had $1,250 of borrowings of commercial paper, with a weighted average interest rate of 0.27%, and

no borrowings under its Credit Agreement and money market lines.

As of January 31, 2015, the Company had outstanding letters of credit in the amount of $233, of which

$10 reduces funds available under the Company’s Credit Agreement. The letters of credit are maintained

primarily to support performance, payment, deposit or surety obligations of the Company.