Kroger 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-4

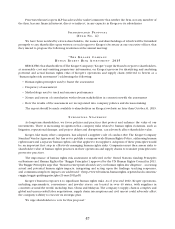

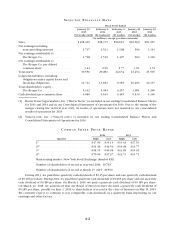

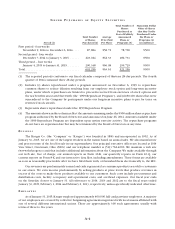

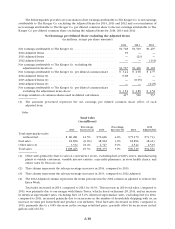

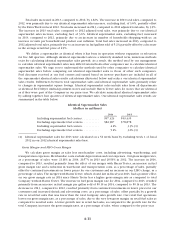

IS S U E R P U R C H A S E S O F E Q U I T Y S E C U R I T I E S

Period (1)

Total Number

of Shares

Purchased (2)

Average

Price Paid

Per Share

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs (3)

Maximum Dollar

Value of Shares

that May Yet Be

Purchased Under

the Plans or

Programs (4)

(in millions)

First period - four weeks

November 9, 2014 to December 6, 2014 . . . . 87,884 $58.72 78,700 $500

Second period - four weeks

December 7, 2014 to January 3, 2015 . . . . . . 223,024 $62.33 182,731 $500

Third period – four weeks

January 4, 2015 to January 31, 2015 . . . . . . . . 290,348 $66.08 259,725 $500

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 601,256 $63.61 521,156 $500

(1) The reported periods conform to our fiscal calendar composed of thirteen 28-day periods. The fourth

quarter of 2014 contained three 28-day periods.

(2) Includes (i) shares repurchased under a program announced on December 6, 1999 to repurchase

common shares to reduce dilution resulting from our employee stock option and long-term incentive

plans, under which repurchases are limited to proceeds received from exercises of stock options and

the tax benefits associated therewith (the “1999 Repurchase Program”), and (ii) 80,100 shares that were

surrendered to the Company by participants under our long-term incentive plans to pay for taxes on

restricted stock awards.

(3) Represents shares repurchased under the 1999 Repurchase Program.

(4) The amounts shown in this column reflect the amount remaining under the $500 million share repurchase

program authorized by the Board of Directors and announced on June 26, 2014. Amounts available under

the 1999 Repurchase Program are dependent upon option exercise activity. The repurchase programs

do not have an expiration date but may be terminated by the Board of Directors at any time.

BU S I N E S S

The Kroger Co. (the “Company” or “Kroger”) was founded in 1883 and incorporated in 1902. As of

January 31, 2015, we are one of the largest retailers in the nation based on annual sales. We also manufacture

and process some of the food for sale in our supermarkets. Our principal executive offices are located at 1014

Vine Street, Cincinnati, Ohio 45202, and our telephone number is (513) 762-4000. We maintain a web site

(www.thekrogerco.com) that includes additional information about the Company. We make available through

our web site, free of charge, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our

current reports on Form 8-K and our interactive data files, including amendments. These forms are available

as soon as reasonably practicable after we have filed them with, or furnished them electronically to, the SEC.

Our revenues are predominately earned and cash is generated as consumer products are sold to customers

in our stores. We earn income predominantly by selling products at price levels that produce revenues in

excess of the costs to make these products available to our customers. Such costs include procurement and

distribution costs, facility occupancy and operational costs, and overhead expenses. Our fiscal year ends

on the Saturday closest to January 31. All references to 2014, 2013 and 2012 are to the fiscal years ended

January 31, 2015, February 1, 2014 and February 2, 2013, respectively, unless specifically indicated otherwise.

EM P L O Y E E S

As of January 31, 2015, Kroger employed approximately 400,000 full- and part-time employees. A majority

of our employees are covered by collective bargaining agreements negotiated with local unions affiliated with

one of several different international unions. There are approximately 300 such agreements, usually with

terms of three to five years.