Kroger 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-39

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

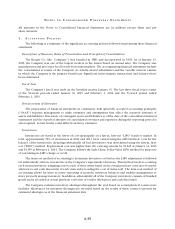

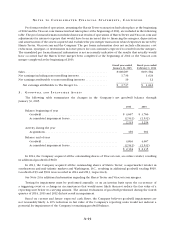

Uncertain Tax Positions

The Company reviews the tax positions taken or expected to be taken on tax returns to determine

whether and to what extent a benefit can be recognized in its consolidated financial statements. Refer to Note

5 for the amount of unrecognized tax benefits and other related disclosures related to uncertain tax positions.

Various taxing authorities periodically audit the Company’s income tax returns. These audits include

questions regarding the Company’s tax filing positions, including the timing and amount of deductions and

the allocation of income to various tax jurisdictions. In evaluating the exposures connected with these various

tax filing positions, including state and local taxes, the Company records allowances for probable exposures.

A number of years may elapse before a particular matter, for which an allowance has been established, is

audited and fully resolved. As of January 31, 2015, the Internal Revenue Service had concluded its examination

of the Company’s 2008 and 2009 federal tax returns. Tax years 2010 through 2013 remain under examination.

The assessment of the Company’s tax position relies on the judgment of management to estimate the

exposures associated with the Company’s various filing positions.

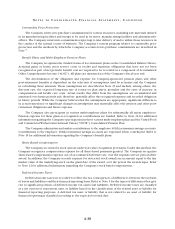

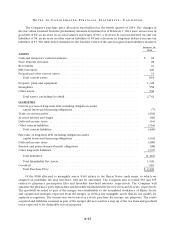

Self-Insurance Costs

The Company is primarily self-insured for costs related to workers’ compensation and general liability

claims. Liabilities are actuarially determined and are recognized based on claims filed and an estimate of

claims incurred but not reported. The liabilities for workers’ compensation claims are accounted for on a

present value basis. The Company has purchased stop-loss coverage to limit its exposure to any significant

exposure on a per claim basis. The Company is insured for covered costs in excess of these per claim limits.

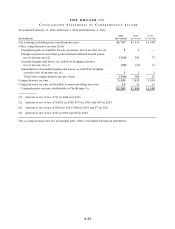

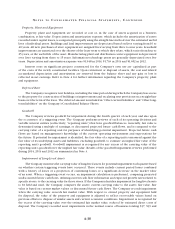

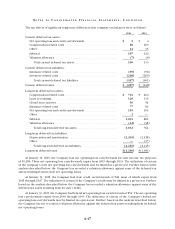

The following table summarizes the changes in the Company’s self-insurance liability through

January 31, 2015.

2014 2013 2012

Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 569 $ 537 $ 529

Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 246 220 215

Claim payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (216) (215) (207)

Assumed from Harris Teeter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 27 —

Ending balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 599 569 537

Less: Current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (213) (224) (205)

Long-term portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 386 $ 345 $ 332

The current portion of the self-insured liability is included in “Other current liabilities,” and the long-term

portion is included in “Other long-term liabilities” in the Consolidated Balance Sheets.

The Company maintains surety bonds related to self-insured workers’ compensation claims. These

bonds are required by most states in which the Company is self-insured for workers’ compensation and are

placed with third-party insurance providers to insure payment of the Company’s obligations in the event the

Company is unable to meet its claim payment obligations up to its self-insured retention levels. These bonds

do not represent liabilities of the Company, as the Company has recorded reserves for the claim costs.

The Company is similarly self-insured for property-related losses. The Company maintains stop loss

coverage to limit its property loss exposures including coverage for earthquake, wind, flood and other

catastrophic events.

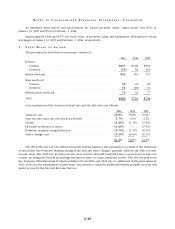

Revenue Recognition

Revenues from the sale of products are recognized at the point of sale. Discounts provided to customers

by the Company at the time of sale, including those provided in connection with loyalty cards, are recognized

as a reduction in sales as the products are sold. Discounts provided by vendors, usually in the form of paper