Kroger 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-50

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

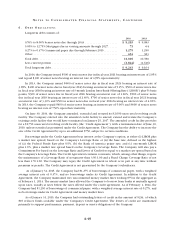

Most of the Company’s outstanding public debt is subject to early redemption at varying times and

premiums, at the option of the Company. In addition, subject to certain conditions, some of the Company’s

publicly issued debt will be subject to redemption, in whole or in part, at the option of the holder upon the

occurrence of a redemption event, upon not less than five days’ notice prior to the date of redemption, at a

redemption price equal to the default amount, plus a specified premium. “Redemption Event” is defined in

the indentures as the occurrence of (i) any person or group, together with any affiliate thereof, beneficially

owning 50% or more of the voting power of the Company, (ii) any one person or group, or affiliate thereof,

succeeding in having a majority of its nominees elected to the Company’s Board of Directors, in each case,

without the consent of a majority of the continuing directors of the Company or (iii) both a change of control

and a below investment grade rating.

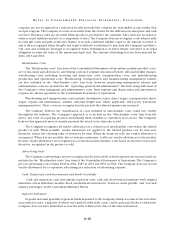

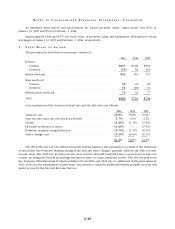

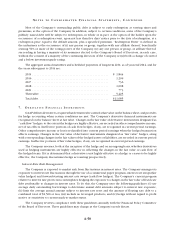

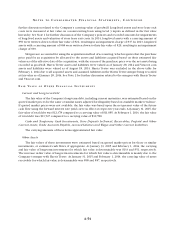

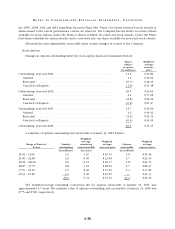

The aggregate annual maturities and scheduled payments of long-term debt, as of year-end 2014, and for

the years subsequent to 2014 are:

2015 ................................................. $ 1,844

2016 ................................................. 1,299

2017 ................................................. 736

2018 ................................................. 1,008

2019 ................................................. 773

Thereafter ............................................ 5,425

Total debt ............................................. $11,085

7. D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S

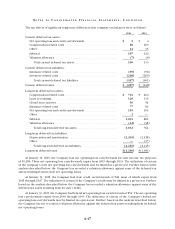

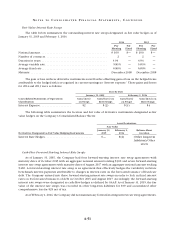

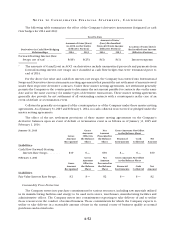

GAAP defines derivatives, requires that derivatives be carried at fair value on the balance sheet, and provides

for hedge accounting when certain conditions are met. The Company’s derivative financial instruments are

recognized on the balance sheet at fair value. Changes in the fair value of derivative instruments designated as

“cash flow” hedges, to the extent the hedges are highly effective, are recorded in other comprehensive income,

net of tax effects. Ineffective portions of cash flow hedges, if any, are recognized in current period earnings.

Other comprehensive income or loss is reclassified into current period earnings when the hedged transaction

affects earnings. Changes in the fair value of derivative instruments designated as “fair value” hedges, along

with corresponding changes in the fair values of the hedged assets or liabilities, are recorded in current period

earnings. Ineffective portions of fair value hedges, if any, are recognized in current period earnings.

The Company assesses, both at the inception of the hedge and on an ongoing basis, whether derivatives

used as hedging instruments are highly effective in offsetting the changes in the fair value or cash flow of

the hedged items. If it is determined that a derivative is not highly effective as a hedge or ceases to be highly

effective, the Company discontinues hedge accounting prospectively.

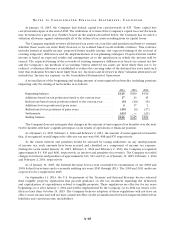

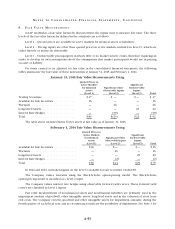

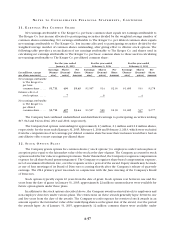

Interest Rate Risk Management

The Company is exposed to market risk from fluctuations in interest rates. The Company manages its

exposure to interest rate fluctuations through the use of a commercial paper program, interest rate swaps (fair

value hedges) and forward-starting interest rate swaps (cash flow hedges). The Company’s current program

relative to interest rate protection contemplates hedging the exposure to changes in the fair value of fixed-rate

debt attributable to changes in interest rates. To do this, the Company uses the following guidelines: (i) use

average daily outstanding borrowings to determine annual debt amounts subject to interest rate exposure,

(ii) limit the average annual amount subject to interest rate reset and the amount of floating rate debt to a

combined total of $2,500 or less, (iii) include no leveraged products, and (iv) hedge without regard to profit

motive or sensitivity to current mark-to-market status.

The Company reviews compliance with these guidelines annually with the Financial Policy Committee

of the Board of Directors. These guidelines may change as the Company’s needs dictate.