Kroger 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-72

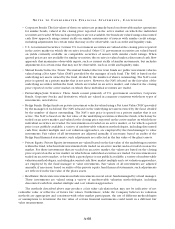

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

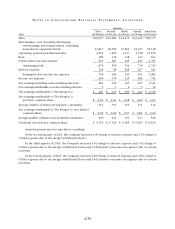

Based on the most recent information available to it, the Company believes the present value of actuarial

accrued liabilities in most of these multi-employer plans substantially exceeds the value of the assets held

in trust to pay benefits. Moreover, if the Company were to exit certain markets or otherwise cease making

contributions to these funds, the Company could trigger a substantial withdrawal liability. Any adjustment for

withdrawal liability will be recorded when it is probable that a liability exists and can be reasonably estimated.

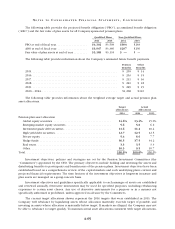

The Company also contributes to various other multi-employer benefit plans that provide health

and welfare benefits to active and retired participants. Total contributions made by the Company to these

other multi-employer health and welfare plans were approximately $1,200 in 2014, $1,100 in 2013 and

$1,100 in 2012.

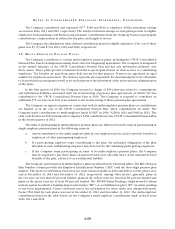

17. R E C E N T L Y A D O P T E D A C C O U N T I N G S T A N D A R D S

In February 2013, the Financial Accounting Standards Board (“FASB”) amended its standards on

comprehensive income by requiring disclosure of information about amounts reclassified out of AOCI by

component. Specifically, the amendment requires disclosure of the effect of significant reclassifications

out of AOCI on the respective line items in net income in which the item was reclassified if the amount

being reclassified is required to be reclassified to net income in its entirety in the same reporting period. It

requires cross reference to other disclosures that provide additional detail for amounts that are not required

to be reclassified in their entirety in the same reporting period. This new disclosure became effective

for the Company beginning February 3, 2013, and was adopted prospectively in accordance with the

standard. See Note 9 to the Consolidated Financial Statements for the Company’s disclosures related to this

amended standard.

In July 2013, the FASB amended ASC 740, “Income Taxes.” The amendment provides guidance on the

financial statement presentation of an unrecognized tax benefit, as either a reduction of a deferred tax asset or

as a liability, when a net operating loss carryforward, similar tax loss, or a tax credit carryforward exists. This

amendment became effective for the Company beginning February 2, 2014, and was adopted prospectively in

accordance with the standard. The adoption of this amendment did not have an effect on net income and did

not have a significant effect on the Consolidated Balance Sheets.

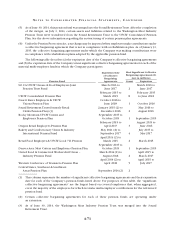

1 8 . R E C E N T L Y I S S U E D A C C O U N T I N G S T A N D A R D S

In May 2014, FASB issued Accounting Standards Update (“ASU”) 2014-09, “Revenue from Contracts with

Customers”, which provides guidance for revenue recognition. The standard’s core principle is that a company

will recognize revenue when it transfers promised goods or services to customers in an amount that reflects

the consideration to which the company expects to be entitled in exchange for those goods or services. This

guidance will be effective for the Company in the first quarter of its fiscal year ending January 27, 2018. Early

adoption is not permitted. The Company is currently in the process of evaluating the effect of adoption of this

ASU on the Consolidated Financial Statements.