Foot Locker 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

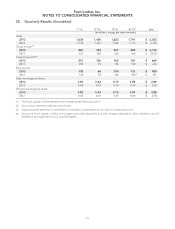

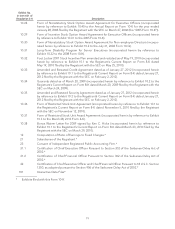

25. Quarterly Results (Unaudited)

1

st

Q2

nd

Q3

rd

Q4

th

Q

(1)

Year

(in millions, except per share amounts)

Sales

2013 1,638 1,454 1,622 1,791 $ 6,505

2012 1,578 1,367 1,524 1,713 $ 6,182

Gross margin

(2)

2013 561 453 537 582 $ 2,133

2012 537 428 505 564 $ 2,034

Operating profit

(3)

2013 215 106 162 181 $ 664

2012 202 93 156 159 $ 610

Net income

2013 138 66 104 121 $ 429

2012 128 59 106 104

(4)

$ 397

Basic earnings per share:

2013 0.92 0.44 0.70 0.83 $ 2.89

2012 0.84 0.39 0.70 0.69 $ 2.62

Diluted earnings per share:

2013 0.90 0.44 0.70 0.81 $ 2.85

2012 0.83 0.39 0.69 0.68 $ 2.58

(1) The fourth quarter of 2012 represents the 14 weeks ended February 2, 2013.

(2) Gross margin represents sales less cost of sales.

(3) Operating profit represents income before income taxes, interest expense, net, and non-operating income.

(4) During the fourth quarter of 2012, the Company recorded impairment and other charges totaling $12 million related to its CCS

tradename and impairment of CCS long-lived assets.

71