Foot Locker 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

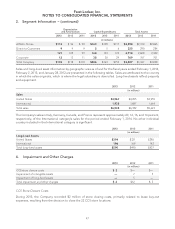

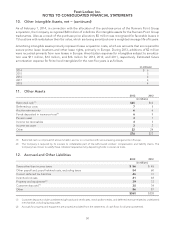

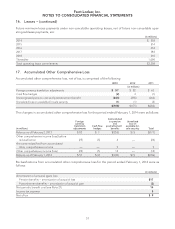

10. Other Intangible Assets, net − (continued)

As of February 1, 2014, in connection with the allocation of the purchase price of the Runners Point Group

acquisition, the Company recognized $30 million of indefinite life intangible assets for the Runners Point Group

tradenames. Also as a result of the purchase price allocation, $5 million was recognized for favorable leases in

15 locations with rents below their fair value, which are being amortized over a weighted-average life of 6 years.

Amortizing intangible assets primarily represent lease acquisition costs, which are amounts that are required to

secure prime lease locations and other lease rights, primarily in Europe. During 2013, additions of $2 million

were recorded primarily from new leases in Europe. Amortization expense for intangibles subject to amortiza-

tion was $11 million, $14 million, and $16 million for 2013, 2012, and 2011, respectively. Estimated future

amortization expense for finite lived intangibles for the next five years is as follows:

(in millions)

2014 $6

2015 5

2016 4

2017 4

2018 4

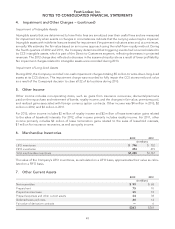

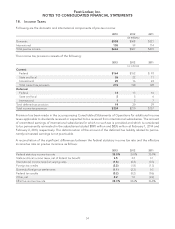

11. Other Assets

2013 2012

(in millions)

Restricted cash

(1)

$25 $16

Deferred tax costs 75

Auction rate security 66

Funds deposited in insurance trust

(2)

69

Pension asset 47

Income tax receivables 43

Income tax asset 22

Other 22 24

$76 $72

(1) Restricted cash is comprised of amounts held in escrow in connection with various leasing arrangements in Europe.

(2) The Company is required by its insurers to collateralize part of the self-insured workers’ compensation and liability claims. The

Company has chosen to satisfy these collateral requirements by depositing funds in insurance trusts.

12. Accrued and Other Liabilities

2013 2012

(in millions)

Taxes other than income taxes $56 $45

Other payroll and payroll related costs, excluding taxes 54 60

Current deferred tax liabilities 46 31

Incentive bonuses 41 48

Property and equipment

(2)

39 33

Customer deposits

(1)

38 34

Other 86 87

$360 $338

(1) Customer deposits include unredeemed gift cards and certificates, merchandise credits, and deferred revenue related to undelivered

merchandise, including layaway sales.

(2) Accruals for property and equipment are properly excluded from the statements of cash flows for all years presented.

50