Foot Locker 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

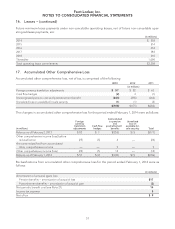

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

18. Income Taxes

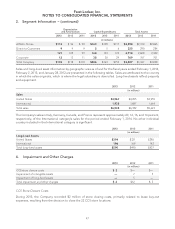

Following are the domestic and international components of pre-tax income:

2013 2012 2011

(in millions)

Domestic $558 $508 $321

International 105 99 114

Total pre-tax income $663 $607 $435

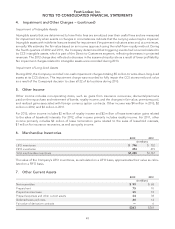

The income tax provision consists of the following:

2013 2012 2011

(in millions)

Current:

Federal $164 $152 $ 93

State and local 26 22 11

International 25 16 24

Total current tax provision 215 190 128

Deferred:

Federal 13 13 16

State and local 556

International 127

Total deferred tax provision 19 20 29

Total income tax provision $234 $210 $157

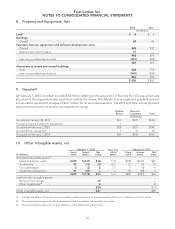

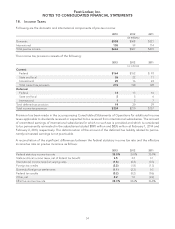

Provision has been made in the accompanying Consolidated Statements of Operations for additional income

taxes applicable to dividends received or expected to be received from international subsidiaries. The amount

of unremitted earnings of international subsidiaries for which no such tax is provided and which is considered

to be permanently reinvested in the subsidiaries totaled $890 million and $835 million at February 1, 2014 and

February 2, 2013, respectively. The determination of the amount of the deferred tax liability related to perma-

nently reinvested earnings is not practicable.

A reconciliation of the significant differences between the federal statutory income tax rate and the effective

income tax rate on pre-tax income is as follows:

2013 2012 2011

Federal statutory income tax rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal tax benefit 3.5 3.2 3.1

International income taxed at varying rates (1.6) (0.4) (0.3)

Foreign tax credits (2.5) (1.8) (1.3)

Domestic/foreign tax settlements (1.1) (2.2) 0.3

Federal tax credits (0.2) (0.2) (0.6)

Other, net 2.2 1.0 (0.2)

Effective income tax rate 35.3% 34.6% 36.0%

54