Foot Locker 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

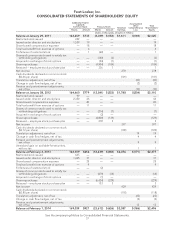

Foot Locker, Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Additional Paid-In

Capital &

Common Stock Treasury Stock Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Total

Shareholders’

EquityShares Amount Shares Amount

(shares in thousands, amounts in millions)

Balance at January 29, 2011 162,659 $735 (8,039) $(152) $1,611 $(169) $2,025

Restricted stock issued 242 — — — —

Issued under director and stock plans 1,559 19 — — 19

Share-based compensation expense — 18 — — 18

Total tax benefit from exercise of options — 6 6

Forfeitures of restricted stock — 1 (60) — 1

Shares of common stock used to satisfy tax

withholding obligations — — (140) (3) (3)

Acquired in exchange of stock options — — (34) (1) (1)

Share repurchases — — (4,904) (104) (104)

Reissued − employee stock purchase plan — — 336 7 7

Net income 278 278

Cash dividends declared on common stock

($0.66 per share) (101) (101)

Translation adjustment, net of tax (23) (23)

Change in cash flow hedges, net of tax (2) (2)

Pension and postretirement adjustments,

net of tax (10) (10)

Balance at January 28, 2012 164,460 $779 (12,841) $(253) $1,788 $(204) $2,110

Restricted stock issued 99 — — — —

Issued under director and stock plans 2,350 46 — — 46

Share-based compensation expense — 20 — — 20

Total tax benefit from exercise of options — 11 — 11

Shares of common stock used to satisfy tax

withholding obligations — — (214) (7) (7)

Acquired in exchange of stock options — — (2) — —

Share repurchases — — (4,000) (129) (129)

Reissued − employee stock purchase plan — — 218 5 5

Net income 397 397

Cash dividends declared on common stock

($0.72 per share) (109) (109)

Translation adjustment, net of tax 19 19

Change in cash flow hedges, net of tax 4 4

Pension and postretirement adjustments,

net of tax 99

Unrealized gain on available-for-securities,

with no tax 11

Balance at February 2, 2013 166,909 $856 (16,839) $(384) $2,076 $(171) $2,377

Restricted stock issued 665 — — — —

Issued under director and stock plans 1,465 31 — — 31

Share-based compensation expense — 25 — — 25

Total tax benefit from exercise of options — 9 9

Forfeitures of restricted stock — — (2)

Shares of common stock used to satisfy tax

withholding obligations — — (479) (16) (16)

Acquired in exchange of stock options — — (1) — —

Share repurchases — — (6,424) (229) (229)

Reissued − employee stock purchase plan — — 133 3 3

Net income 429 429

Cash dividends declared on common stock

($0.80 per share) (118) (118)

Translation adjustment, net of tax (25) (25)

Change in cash flow hedges, net of tax (5) (5)

Pension and postretirement adjustments,

net of tax 15 15

Balance at February 1, 2014 169,039 $921 (23,612) $(626) $2,387 $(186) $2,496

See Accompanying Notes to Consolidated Financial Statements.

37