Foot Locker 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

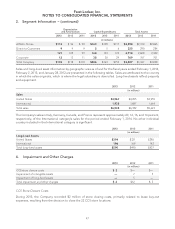

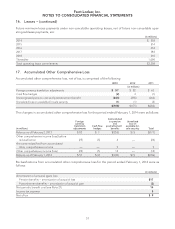

16. Leases − (continued)

Future minimum lease payments under non-cancelable operating leases, net of future non-cancelable oper-

ating sublease payments, are:

(in millions)

2014 $ 558

2015 514

2016 453

2017 383

2018 310

Thereafter 1,090

Total operating lease commitments $3,308

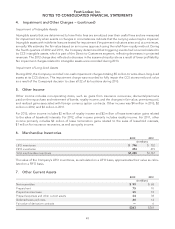

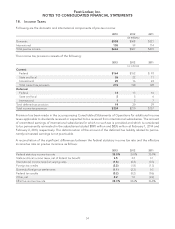

17. Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss, net of tax, is comprised of the following:

2013 2012 2011

(in millions)

Foreign currency translation adjustments $57 $82 $63

Cash flow hedges (2) 3 (1)

Unrecognized pension cost and postretirement benefit (240) (255) (264)

Unrealized loss on available-for-sale security (1) (1) (2)

$(186) $(171) $(204)

The changes in accumulated other comprehensive loss for the period ended February 1, 2014 were as follows:

(in millions)

Foreign

currency

translation

adjustments Cash flow

hedges

Items related

to pension

and

postretirement

benefits

Unrealized

loss on

available-for-

sale security Total

Balance as of February 2, 2013 $ 82 $ 3 $(255) $ (1) $(171)

Other comprehensive income (loss) before

reclassification (25) (5) 6 — (24)

Amounts reclassified from accumulated

other comprehensive income — — 9 — 9

Other comprehensive income (loss) (25) (5) 15 — (15)

Balance as of February 1, 2014 $ 57 $ (2) $(240) $ (1) $(186)

Reclassifications from accumulated other comprehensive loss for the period ended February 1, 2014 were as

follows:

(in millions)

Amortization of actuarial (gain) loss:

Pension benefits − amortization of actuarial loss $17

Postretirement benefits − amortization of actuarial gain (3)

Net periodic benefit cost (see Note 21) 14

Income tax expense 5

Net of tax $9

53