Foot Locker 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

STRENGTHS

Our nancial performance has not only improved to new

heights in recent years, it has also become more consistent. Much

of this consistency stems from the various aspects of diversity in

our business that we have achieved by executing our strategies.

First, we have not only a strong men’s business, we also have

a very robust children’s business that will continue to provide

growth opportunities, and a very signicant women’s business

which we are focused on bringing up to the productivity level

of the rest of the business.

Second, we not only developed a strong basketball busi-

ness, but our running business, our casual offerings, and our

apparel assortments are also much stronger compared to

a few years ago, and give us a better merchandise balance

than before.

Third, we have clearly differentiated our banners, enabling

each of them to focus on a particular customer group. We

have banners, such as Foot Locker, Eastbay, Runners Point, and

SIX:02, that concentrate on high-performance footwear and

apparel, and we have banners, such as Footaction, Sidestep,

and CCS, that offer a much more lifestyle product assortment

unique to each banner. Our banner with our biggest stores,

Champs Sports, is able to serve customers effectively across

a broad athletic spectrum, while concentrating on the kid who

knows game, who lives and breathes sports. Among the many

benets of this differentiation is our ability to create truly great

marketing campaigns that draw customers to our unique store

banners and digital sites.

Fourth, we are no longer just a U.S.-focused company with

a modest international presence. We are now a large global

company. We operate more than 1,000 stores in 22 countries

outside the United States, as well as various local country web-

sites, and we are approaching $2 billion in international

sales. We also have another 73 stores in 9 countries operated

by our franchise partners. Clearly, people around the world

enjoy wearing the premium sneakers and athletic apparel that

we sell.

Finally, we are not just a bricks and mortar business.

We now have a strong, fast-growing collection of digital sites,

both in the United States and abroad. Our biggest digital

business, Eastbay, is the premier destination for the elite high

school or club athlete, and our store banner e-commerce

sites, such as footlocker.com, continue to increase sales at a

rapid pace, an impressive 40 percent rate in

2013. Our overall digital business has now

grown to 11 percent of our total sales.

OPPORTUNITIES

The set of strengths I described

above lead directly to an exciting

number of signicant opportunities

for us to pursue over the next

several years. In the relatively near

term, which I dene as this year

and into next, we have several

initiatives already paying dividends

upon which to build. These include, rst,

our children’s business, the success of

which can be seen not just in our Kids Foot

Locker business, where sales increased at

a mid-teen pace in 2013, but in the growth

of our children’s business across all of our

banners, channels, and geographies. We

are doing a much better job buying and

displaying kids’ merchandise, and our

vendor partners have also improved their

product offerings.

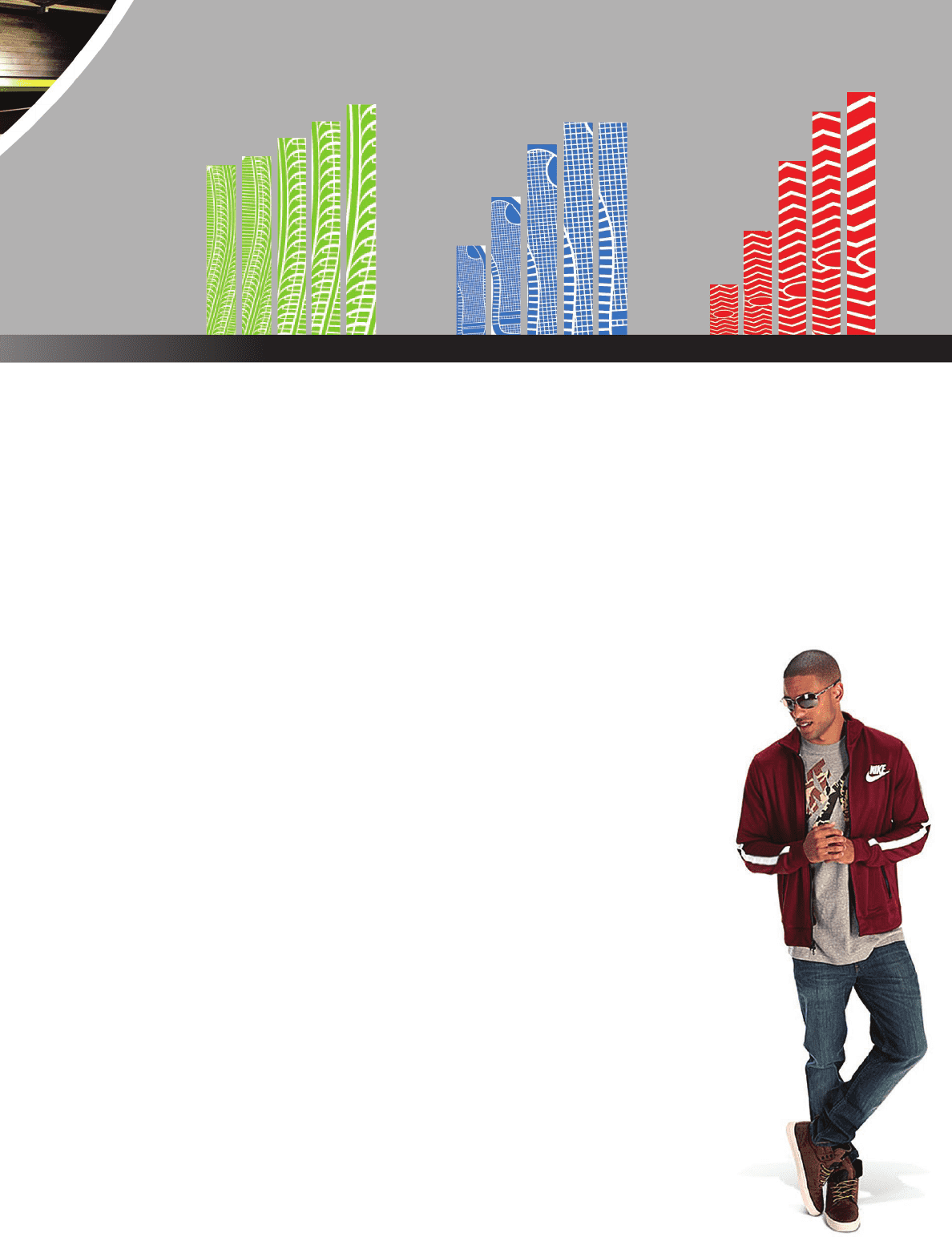

$1.10

$1.82

$2.47

30.0%

31.9%

32.8% 32.8%

27.7%

$5.0

$6.5

$6.1

EPS

GROSS MARGIN

TOTAL SALES

2009 2010 2011 2012 2013

$5.6

$2.87

$4.9

$0.54

2009 2010 2011 2012 2013 2009 2010 2011 2012 2013