Foot Locker 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

21. Retirement Plans and Other Benefits − (continued)

As of February 1, 2014 and February 2, 2013, the Canadian qualified pension plan’s assets exceeded its accu-

mulated benefit obligation.

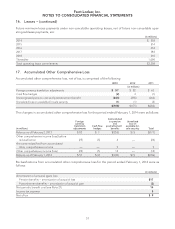

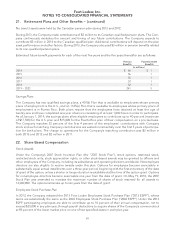

Information for pension plans with an accumulated benefit obligation in excess of plan assets is as follows:

2013 2012

(in millions)

Projected benefit obligation $ 603 $625

Accumulated benefit obligation 603 625

Fair value of plan assets 575 585

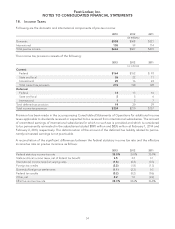

The following tables set forth the changes in accumulated other comprehensive loss (pre-tax) at February 1, 2014:

Pension

Benefits Postretirement

Benefits

(in millions)

Net actuarial loss (gain) at beginning of year $ 426 $(16)

Amortization of net (loss) gain (17) 3

(Gain) loss arising during the year (5) —

Foreign currency fluctuations (5) —

Net actuarial loss (gain) at end of year

(1)

$ 399 $(13)

Net prior service cost at end of year

(1)

1—

Total amount recognized $ 400 $(13)

(1) The net prior service cost did not change during the year. The amounts in accumulated other comprehensive loss that are expected

to be recognized as components of net periodic benefit cost (income) during the next year are approximately $16 million and $(3)

million related to the pension and postretirement plans, respectively.

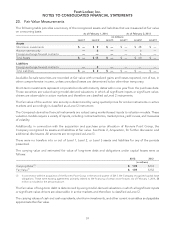

The following weighted-average assumptions were used to determine the benefit obligations under the plans:

Pension Benefits Postretirement Benefits

2013 2012 2013 2012

Discount rate 4.32% 3.79% 4.20% 3.70%

Rate of compensation increase 3.69% 3.68%

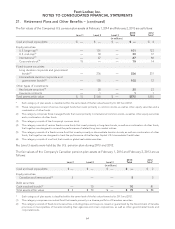

Pension expense is actuarially calculated annually based on data available at the beginning of each year. The

expected return on plan assets is determined by multiplying the expected long-term rate of return on assets by

the market-related value of plan assets for the U.S. qualified pension plan and market value for the Canadian

qualified pension plan. The market-related value of plan assets is a calculated value that recognizes investment

gains and losses in fair value related to equities over three or five years, depending on which computation

results in a market-related value closer to market value. Market-related value for the U.S. qualified plan was

$579 million and $550 million for 2013 and 2012, respectively.

61