Foot Locker 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FINANCIAL HIGHLIGHTS

Before I discuss our ongoing strengths, I will rst

touch on the major highlights of Foot Locker, Inc.’s

nancial performance in 2013. The Company earned

net income of $432 million in 2013, an increase of 14

percent over last year’s record-setting performance.

Earnings per share increased 16 percent, from $2.47

to $2.87, reecting both the improved net income and the

investment we have made in reducing our outstanding share

count by repurchasing shares of our stock.

Comparable store sales increased 4.2 percent in 2013, while

total sales increased 6.6 percent to $6.5 billion. The difference

in growth between comparable store sales and

total sales was due primarily to our acquisition

this past summer of Runners Point Group,

an exciting addition to our business.

In a challenging retail environment

notable in 2013 for its promotional

intensity, we were able to maintain

our gross margin rate at its record

high of 32.8 percent of sales,

while effectively managing

expenses to produce an

improvement in our selling,

general, and administrative

expense rate to our best-

ever 20.4 percent of sales.

Our earnings before interest

and taxes (EBIT) improved to 10.4

percent of sales, up half a percent

from last year and also a record

performance for our Company.

Our business gen-

erated a signicant

amount of cash in 2013,

which not only enabled us to

remain strong nancially, it also

enabled us to:

• invest more than $200 million of capital into our business.

These investments include store remodels to make our real

estate more exciting places to shop and buy; additional tools

and training to help our associates serve our customers even

better; systems and processes to make our people, space,

and inventory more productive; and enhancements to our

digital sites and customer engagement.

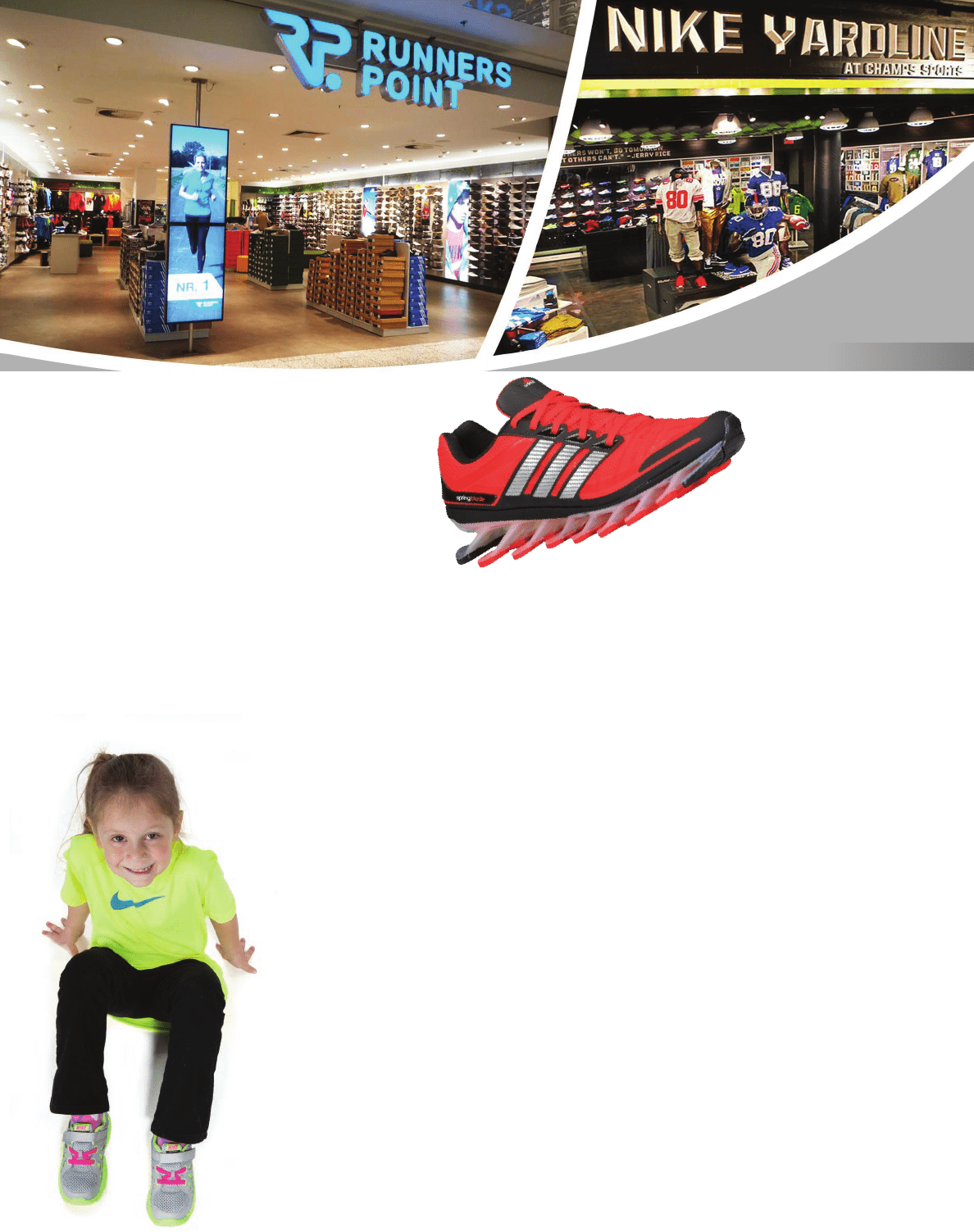

• acquire Runners Point Group, a protable, multi-banner,

multi-channel, athletic retailer in Germany. We are integrating

this business under the Foot Locker Europe umbrella, and

it gives us a tremendous opportunity to carefully segment

the customer base in Germany --- as we have done in

the United States with Foot Locker, Champs Sports,

Footaction, and Eastbay. We will also explore opportunities

to thoughtfully expand our newly-acquired banners, Runners

Point and Sidestep, outside Germany alongside our existing

Foot Locker business.

• pay a meaningful dividend, which we have increased

steadily over the past four years and which now, after our

announcement of a 10 percent dividend rate increase in

February, stands at a strong quarterly rate of 22 cents per

share. That dividend, along with the $229 million we spent

in 2013 repurchasing our own shares, demonstrates a rm

commitment to reward and recognize our shareowners, while

still investing in the many signicant growth opportunities

for our business and maintaining a sound nancial structure.

5