Foot Locker 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

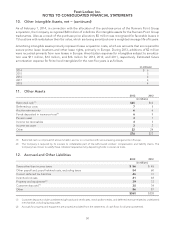

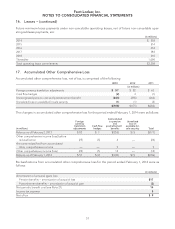

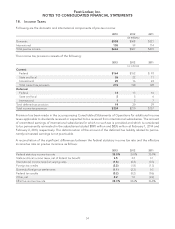

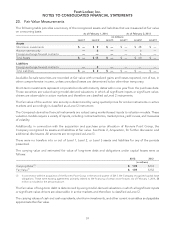

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

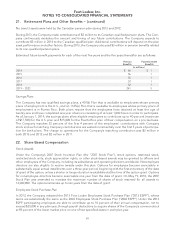

21. Retirement Plans and Other Benefits

Pension and Other Postretirement Plans

The Company has defined benefit pension plans covering certain of its North American employees, which are

funded in accordance with the provisions of the laws where the plans are in effect. In connection with the

acquisition of Runners Point Group, the Company acquired certain pension obligations. In addition to providing

pension benefits, the Company sponsors postretirement medical and life insurance plans, which are available

to most of its retired U.S. employees. These plans are contributory and are not funded. The measurement date

of the assets and liabilities is the last day of the fiscal year.

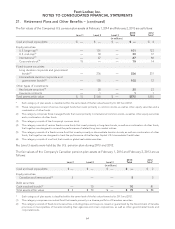

The following tables set forth the plans’ changes in benefit obligations and plan assets, funded status, and

amounts recognized in the Consolidated Balance Sheets, measured at February 1, 2014 and February 2, 2013:

Pension Benefits Postretirement Benefits

2013 2012 2013 2012

(in millions)

Change in benefit obligation

Benefit obligation at beginning of year $ 706 $ 704 $15 $15

Service cost 14 13 ——

Interest cost 25 28 1—

Plan participants’ contributions ——22

Actuarial (gain) loss (11) 15 —1

Foreign currency translation adjustments (9) ———

Runners Point Group acquisition 1———

Benefits paid (52) (54) (3) (3)

Benefit obligation at end of year $ 674 $ 706 $15 $15

Change in plan assets

Fair value of plan assets at beginning of year $ 673 $ 639

Actual return on plan assets 33 59

Employer contributions 529

Foreign currency translation adjustments (9) —

Benefits paid (52) (54)

Fair value of plan assets at end of year $ 650 $ 673

Funded status $ (24) $ (33) $ (15) $ (15)

Amounts recognized on the balance sheet:

Other assets $4 $7 $— $—

Accrued and other liabilities (3) (3) (1) (1)

Other liabilities (25) (37) (14) (14)

$ (24) $ (33) $ (15) $ (15)

Amounts recognized in accumulated other

comprehensive loss, pre-tax:

Net loss (gain) $ 399 $ 426 $ (13) $ (16)

Prior service cost (credit) 11——

$ 400 $427 $ (13) $ (16)

60