Foot Locker 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

22. Share-Based Compensation − (continued)

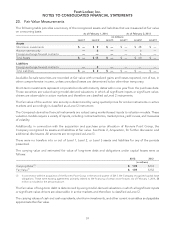

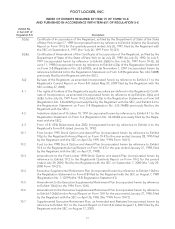

The following table summarizes information about stock options outstanding and exercisable at February 1, 2014:

Options Outstanding Options Exercisable

Range of Exercise Prices Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise Price Number

Exercisable

Weighted-

Average

Exercise Price

(in thousands, except prices per share and contractual life)

$ 9.85 to $15.10 1,665 5.63 $12.53 1,665 $12.53

$18.01 to $23.42 1,569 6.15 $19.70 1,123 $20.03

$23.63 to $34.24 2,397 7.47 $31.44 704 $27.75

$34.27 to $36.59 37 9.21 $34.96 3 $35.27

5,668 6.58 $22.66 3,495 $18.02

Changes in the Company’s nonvested options at February 1, 2014 are summarized as follows:

Number of

Shares

Weighted-

Average

Grant Date

Fair Value

per share

(in thousands, except

prices per share)

Nonvested at February 2, 2013 2,314 $23.18

Granted 1,154 34.25

Vested (1,230) 21.00

Expired or cancelled (65) 29.55

Nonvested at February 1, 2014 2,173 $30.10

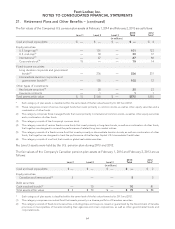

Restricted Stock and Units

Restricted shares of the Company’s common stock and restricted stock units may be awarded to certain officers

and key employees of the Company. Awards made to executives outside of the United States and to nonem-

ployee directors are made in the form of restricted stock units. Each restricted stock unit represents the right to

receive one share of the Company’s common stock provided that the vesting conditions are satisfied. In 2013,

2012, and 2011, there were 1,027,542, 1,254,876, and 1,098,177 restricted stock units outstanding, respectively.

Generally, awards fully vest after the passage of time, typically three years. However, restricted stock unit grants

made in connection with the Company’s long-term incentive program vest after the attainment of certain per-

formance metrics and the passage of time. Restricted stock is considered outstanding at the time of grant and

the holders have voting rights. Dividends are paid to holders of restricted stock that vest with the passage of

time; for performance-based restricted stock, dividends will be accumulated and paid after the performance

criteria are met. No dividends are paid on restricted stock units.

Compensation expense is recognized using the fair market value at the date of grant and is amortized over the

vesting period, provided the recipient continues to be employed by the Company. The Company recorded

compensation expense related to restricted shares, net of estimated forfeitures, of $13 million, $10 million, and

$10 million for 2013, 2012, and 2011, respectively. At February 1, 2014, there was $11 million of total unrecog-

nized compensation cost net of estimated forfeitures, related to nonvested restricted stock awards.

68