Foot Locker 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

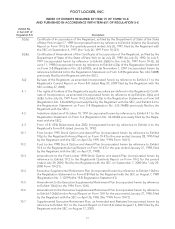

23. Legal Proceedings − (continued)

The Company and the Company’s U.S. retirement plan are defendants in a purported class action (Osberg v.

Foot Locker, filed in the U.S. District Court for the Southern District of New York) in which the plaintiff alleges

that, in connection with the 1996 conversion of the retirement plan to a defined benefit plan with a cash balance

formula, the Company and the retirement plan failed to properly advise plan participants of the ‘‘wear-away’’

effect of the conversion. Plaintiff asserted claims for: (a) breach of fiduciary duty under the Employee Retire-

ment Income Security Act of 1974 (ERISA); (b) violation of the statutory provisions governing the content of the

Summary Plan Description; (c) violation of the notice provision of Section 204(h) of ERISA; and (d) violation of

ERISA’s age discrimination provisions. In September 2009, the court granted the Company’s motion to dismiss

the Section 204(h) claim and the age discrimination claim. In December 2012, the court granted the Company’s

motion for summary judgment on the remaining two claims, dismissing the action. Plaintiff appealed to the U.S.

Court of Appeals for the Second Circuit, which issued a Summary Order on February 13, 2014 that affirmed the

judgment of the District Court in part, and vacated and remanded in part.

Management does not believe that the outcome of any such legal proceedings pending against the Company

or its consolidated subsidiaries, including In re Foot Locker, Inc. Fair Labor Standards Act and Wage and Hour

Litigation,Hill, Cortes, Kissinger, and Osberg, as described above, would have a material adverse effect on the

Company’s consolidated financial position, liquidity, or results of operations, taken as a whole. Litigation is

inherently unpredictable, and judgments could be rendered or settlements entered that could adversely affect

the Company’s operating results or cash flows in a particular period.

24. Commitments

In connection with the sale of various businesses and assets, the Company may be obligated for certain lease

commitments transferred to third parties and pursuant to certain normal representations, warranties, or indem-

nifications entered into with the purchasers of such businesses or assets. Although the maximum potential

amounts for such obligations cannot be readily determined, management believes that the resolution of such

contingencies will not have a material effect on the Company’s consolidated financial position, liquidity, or

results of operations. The Company is also operating certain stores and making rental payments for which lease

agreements are in the process of being negotiated with landlords. Although there is no contractual commit-

ment to make these payments, it is likely that a lease will be executed.

The Company does not have any off-balance sheet financing (other than operating leases entered into in the

normal course of business and disclosed above) or unconsolidated special purpose entities. The Company

does not participate in transactions that generate relationships with unconsolidated entities or financial part-

nerships, including variable interest entities.

70