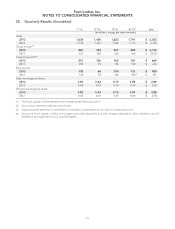

Foot Locker 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

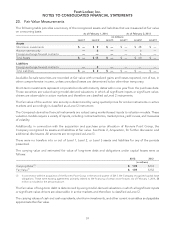

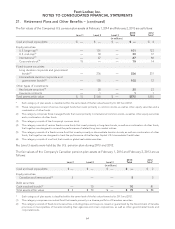

21. Retirement Plans and Other Benefits − (continued)

No Level 3 assets were held by the Canadian pension plan during 2013 and 2012.

During 2013, the Company made contributions of $2 million to its Canadian qualified pension plans. The Com-

pany continuously evaluates the amount and timing of any future contributions. The Company expects to

contribute $2 million in 2014 to the Canadian qualified plan. Additional contributions will depend on the plan

asset performance and other factors. During 2013, the Company also paid $3 million in pension benefits related

to its non-qualified pension plans.

Estimated future benefit payments for each of the next five years and the five years thereafter are as follows:

Pension

Benefits Postretirement

Benefits

(in millions)

2014 $66 $1

2015 56 1

2016 55 1

2017 53 1

2018 52 1

2019 − 2023 241 5

Savings Plans

The Company has two qualified savings plans, a 401(k) Plan that is available to employees whose primary

place of employment is the U.S., and an 1165(e) Plan that is available to employees whose primary place of

employment is in Puerto Rico. Both plans require that the employees have attained at least the age of

twenty-one and have completed one year of service consisting of at least 1,000 hours in order to participate.

As of January 1, 2014, the savings plans allow eligible employees to contribute up to 40 percent (maximum

of $17,500) for the U.S. plan and $15,000 for the Puerto Rico plan of their compensation on a pre-tax basis.

The Company matches 25 percent of the first 4 percent of the employees’ contributions with Company

stock and such matching Company contributions are vested incrementally over the first 5 years of participa-

tion for both plans. The charge to operations for the Company’s matching contribution was $3 million in

both 2013 and 2012 and $2 million in 2011.

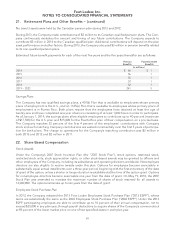

22. Share-Based Compensation

Stock Awards

Under the Company’s 2007 Stock Incentive Plan (the ‘‘2007 Stock Plan’’), stock options, restricted stock,

restricted stock units, stock appreciation rights, or other stock-based awards may be granted to officers and

other employees of the Company, including its subsidiaries and operating divisions worldwide. Nonemployee

directors are also eligible to receive awards under this plan. Options for employees become exercisable in

substantially equal annual installments over a three-year period, beginning with the first anniversary of the date

of grant of the option, unless a shorter or longer duration is established at the time of the option grant. Options

for nonemployee directors become exercisable one year from the date of grant. On May 19, 2010, the 2007

Stock Plan was amended to increase the maximum number of shares of stock reserved for all awards to

12,000,000. The options terminate up to ten years from the date of grant.

Employees Stock Purchase Plan

In 2013, the Company adopted the 2013 Foot Locker Employees Stock Purchase Plan (‘‘2013 ESPP’’), whose

terms are substantially the same as the 2003 Employees Stock Purchase Plan (‘‘2003 ESPP’’). Under the 2013

ESPP participating employees are able to contribute up to 10 percent of their annual compensation, not to

exceed $25,000 in any plan year, through payroll deductions to acquire shares of the Company’s common stock

at 85 percent of the lower market price on one of two specified dates in each plan year.

65