Foot Locker 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

Foot Locker, Inc. common stock (ticker symbol ‘‘FL’’) is listed on The New York Stock Exchange as well as on the

Börse Stuttgart stock exchange in Germany. As of February 1, 2014, the Company had 16,207 shareholders of

record owning 145,426,822 common shares.

The following table provides, for the period indicated, the intra-day high and low sales prices for the Compa-

ny’s common stock:

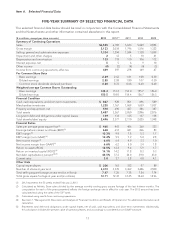

2013 2012

High Low High Low

1

st

Quarter $35.64 $31.30 $32.27 $26.00

2

nd

Quarter 37.70 32.61 34.00 27.86

3

rd

Quarter 37.85 31.91 37.65 32.51

4

th

Quarter 41.73 34.09 36.09 31.07

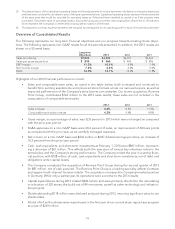

During each of the quarters of 2013 the Company declared a dividend of $0.20 per share. The Board of Direc-

tors reviews the dividend policy and rate, taking into consideration the overall financial and strategic outlook

for our earnings, liquidity, and cash flow projections. On February 18, 2014, the Board of Directors declared a

quarterly dividend of $0.22 per share to be paid on May 2, 2014. This dividend represents a 10 percent increase

over the Company’s previous quarterly per share amount.

The following table is a summary of our fourth quarter share repurchases:

Date Purchased

Total

Number of

Shares

Purchased

(1)

Average

Price Paid

per Share

(1)

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Program

(2)

Approximate

Dollar Value of

Shares that may

yet be Purchased

Under the

Program

(2)

Nov. 3, 2013 − Nov. 30, 2013 164,322 $38.96 164,322 $426,826,201

Dec. 1, 2013 − Jan. 4, 2014 1,411,993 $39.87 1,410,713 $370,576,339

Jan. 5, 2014 − Feb. 1, 2014 — $ — — $370,576,339

1,576,315 $39.78 1,575,035

(1) These columns also reflect shares purchased in connection with stock swaps. The calculation of the average price paid per share

includes all fees, commissions, and other costs associated with the repurchase of such shares.

(2) On February 20, 2013, the Board of Directors approved a new 3-year, $600 million share repurchase program extending through

January 2016, replacing the Company’s previous $400 million program which terminated on that date. Through February 1, 2014, 6.4

million shares of common stock were purchased under the current program, for an aggregate cost of $229 million.

11