Foot Locker 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies − (continued)

Recent Accounting Pronouncements

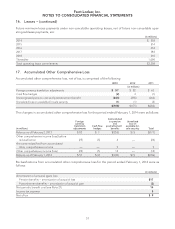

During the first quarter of 2013, the Company adopted Accounting Standards Update 2013-02, Comprehensive

Income (Topic 220): Reporting of Amounts Reclassified out of Accumulated Other Comprehensive Income

(‘‘ASU 2013-02’’). ASU 2013-02 amended existing guidance by requiring additional disclosure either on the face of

the income statement or in the notes to the financial statements of significant amounts reclassified out of accumu-

lated other comprehensive income. The provisions of this new guidance were effective prospectively as of the

beginning of 2013. Accordingly, enhanced footnote disclosure is included in Note 17, Accumulated Other Compre-

hensive Loss. The adoption of ASU 2013-02 had no effect on our results of operations or financial position.

Other recently issued accounting pronouncements did not, or are not believed by management to, have a

material effect on the Company’s present or future consolidated financial statements.

2. Acquisition

Effective July 7, 2013, the Company acquired 100 percent of the shares of Runners Point Warenhandelsgesell-

schaft mbH, (‘‘Runners Point Group’’) a specialty athletic store and online retailer based in Recklinghausen,

Germany. The aggregate purchase price paid for the acquisition was $87 million in cash, subject to adjustment

for finalization of the purchase price for working capital adjustments. At the date of acquisition, Runners Point

Group operated 194 stores in Germany, Austria, and the Netherlands. Additionally, there were 24 Runners Point

Group franchise stores operating in Germany and Switzerland. The acquisition is intended to enhance the

Company’s position in Germany and also provide additional banners to further diversify and expand the Com-

pany’s European business. Also, the addition of the strong digital capabilities of Tredex, the e-commerce

subsidiary of Runners Point Group, allows for the potential of accelerated e-commerce growth in Europe.

The results of Runners Point Group are included in our consolidated financial statements since the acquisi-

tion date.

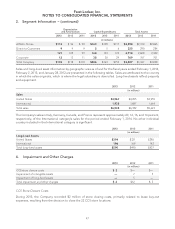

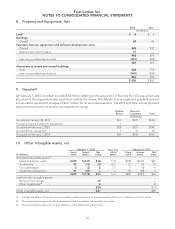

The following table summarizes allocation of the purchase price to the fair value of assets acquired, based on

the exchange rate in effect at the date of our acquisition of Runners Point Group. The Company has allocated

the purchase price, in part, upon internal estimates of cash flows and considering the report of a third-party

valuation expert retained to assist the Company.

(in millions)

Assets acquired:

Cash and cash equivalents $6

Inventory 41

Other current assets 11

Property and equipment 24

Other long-term assets 1

Tradenames 29

(1)

Favorable leases 5

Liabilities assumed:

Accounts payable and other accruals (27)

Income taxes and deferred taxes, net (11)

Obligations under capital leases (9)

Other long-term liabilities (1)

Goodwill 18

Total purchase price $87

(1) Due to foreign currency fluctuations, the U.S. dollar value of tradenames increased to $30 million as of February 1, 2014.

45