Foot Locker 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

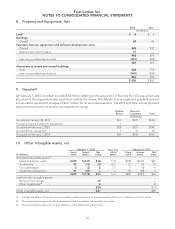

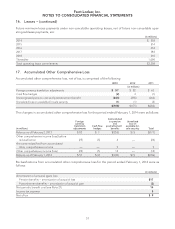

8. Property and Equipment, Net

2013 2012

(in millions)

Land $6 $6

Buildings:

Owned 44 41

Furniture, fixtures, equipment and software development costs:

Owned 888 832

Assets under capital leases 10 —

948 879

Less: accumulated depreciation (621) (622)

327 257

Alterations to leased and owned buildings

Cost 804 772

Less: accumulated amortization (541) (539)

263 233

$ 590 $ 490

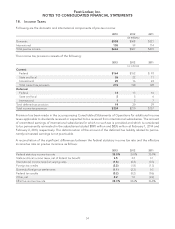

9. Goodwill

At February 1, 2014, Goodwill includes $18 million relating to the acquisition of Runners Point Group, which was

allocated to the segments based upon their relative fair values. The Athletic Stores segment’s goodwill is net of

accumulated impairment charges of $167 million for all periods presented. The 2013 and 2012 annual goodwill

impairment tests did not result in an impairment charge.

Athletic

Stores Direct-to-

Customers Total

(in millions)

Goodwill at January 28, 2012 $17 $127 $144

Foreign currency translation adjustment 1 — 1

Goodwill at February 2, 2013 $18 $127 $145

Goodwill from acquisition 3 15 18

Goodwill at February 1, 2014 $21 $142 $163

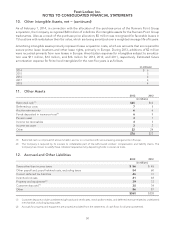

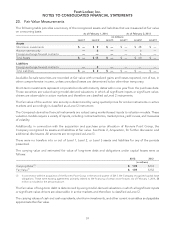

10. Other Intangible Assets, net

February 1, 2014 Wtd. Avg.

Life in

Years

(2)

February 2, 2013

(in millions) Gross

value Accum.

amort. Net

Value Gross

value Accum.

amort. Net

Value

Amortized intangible assets:

(1)

Lease acquisition costs $155 $(137) $18 11.8 $158 $(137) $21

Trademarks 21 (11) 10 19.7 21 (9) 12

Favorable leases 8 (3) 5 7.3 5 (5) —

Customer relationships 21 (21) — — 21 (18) 3

$205 $(172) $33 13.3 $205 $(169) $36

Indefinite life intangible assets:

Runners Point Group 30 —

Other trademarks

(3)

44

$34 $4

Other intangible assets, net $67 $40

(1) Includes the effect of foreign currency translation related primarily to the movements of the euro in relation to the U.S. dollar.

(2) The weighted-average useful life disclosed excludes those assets that are fully amortized.

(3) The accumulated impairment charge related to other trademarks is $24 million.

49