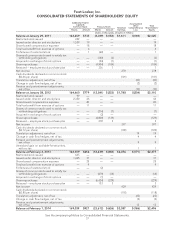

Foot Locker 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

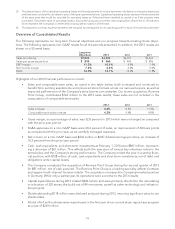

Operating leases are the primary financing vehicle used to fund store expansion and, therefore, we believe that

the inclusion of the present value of operating leases in total debt is useful to our investors, credit constituen-

cies, and rating agencies.

The following table sets forth the components of the Company’s capitalization, both with and without the

present value of operating leases:

2013 2012

(in millions)

Long-term debt and obligations under capital leases $ 139 $ 133

Present value of operating leases 2,571 2,202

Total debt including the present value of operating leases 2,710 2,335

Less:

Cash and cash equivalents 858 880

Short-term investments 948

Total net debt including the present value of operating leases 1,843 1,407

Shareholders’ equity 2,496 2,377

Total capitalization $4,339 $3,784

Total net debt capitalization percent —% —%

Total net debt capitalization percent including the present value of operating leases

(non-GAAP) 42.5% 37.2%

The Company’s cash, cash equivalents, and short-term investments decreased by $61 million during 2013,

representing the acquisition of the Runners Point Group offset in large part by the result of strong cash flow

generation from operating activities.

Including the present value of operating leases, the Company’s net debt capitalization percent increased

530 basis points in 2013. The change in total debt including the present value of the operating leases, as

compared with the prior-year period, primarily reflects the acquisition of Runners Point Group and their

associated lease liabilities, the effect of lease renewals, and the effect of foreign currency fluctuations, offset

in part by store closures.

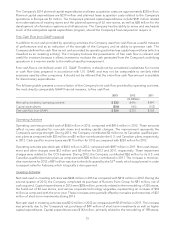

Contractual Obligations and Commitments

The following tables represent the scheduled maturities of the Company’s contractual cash obligations and

other commercial commitments at February 1, 2014:

Payments Due by Fiscal Period

Contractual Cash Obligations Total 2014 2015 − 2016 2017 − 2018 2019 and

Beyond

(in millions)

Long-term debt

(1)

$ 206 $11 $ 22 $ 22 $ 151

Operating leases

(2)

3,308 558 967 693 1,090

Capital leases 8 35— —

Other long-term liabilities

(3)

22—— —

Total contractual cash obligations $3,524 $574 $994 $715 $1,241

Payments Due by Fiscal Period

Other Commercial Commitments

Total

Amounts

Committed 2014 2015 − 2016 2017 − 2018 2019 and

Beyond

(in millions)

Unused line of credit

(4)

$ 199 $— $199 $— $—

Standby letters of credit 1 —1— —

Purchase commitments

(5)

2,187 2,187 —— —

Other

(6)

35 20 15 — —

Total commercial commitments $2,422 $2,207 $216 $— $—

27