Foot Locker 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

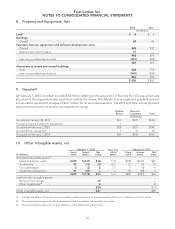

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

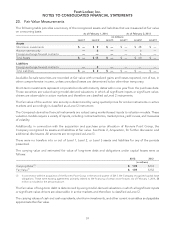

20. Fair Value Measurements

The following table provides a summary of the recognized assets and liabilities that are measured at fair value

on a recurring basis: As of February 1, 2014 As of February 2, 2013

(in millions)

Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Assets

Short-term investments $— $9 $— $— $48 $—

Auction rate security —6——6—

Foreign exchange forward contracts —— — —6—

Total Assets $— $15 $— $— $60 $—

Liabilities

Foreign exchange forward contracts —2——— —

Total Liabilities $— $2 $— $— $— $—

Available-for-sale securities are recorded at fair value with unrealized gains and losses reported, net of tax, in

other comprehensive income, unless unrealized losses are determined to be other than temporary.

Short-term investments represent corporate bonds with maturity dates within one year from the purchase date.

These securities are valued using model-derived valuations in which all significant inputs or significant value-

drivers are observable in active markets and therefore are classified as Level 2 instruments.

The fair value of the auction rate security is determined by using quoted prices for similar instruments in active

markets and accordingly is classified as a Level 2 instrument.

The Company’s derivative financial instruments are valued using market-based inputs to valuation models. These

valuation models require a variety of inputs, including contractual terms, market prices, yield curves, and measures

of volatility.

Additionally, in connection with the acquisition and purchase price allocation of Runners Point Group, the

Company recognized its assets and liabilities at fair value. See Note 2, Acquisition, for further discussion and

additional disclosures. All amounts are recognized as Level 3.

There were no transfers into or out of Level 1, Level 2, or Level 3 assets and liabilities for any of the periods

presented.

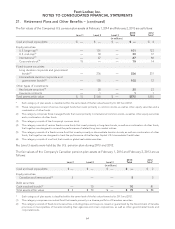

The carrying value and estimated fair value of long-term debt and obligations under capital leases were as

follows:

2013 2012

(in millions)

Carrying Value

(1)

$ 139 $133

Fair Value

(1)

$ 159 $152

(1) In connection with the acquisition of the Runners Point Group in the second quarter of 2013, the Company recognized capital lease

obligations. These were existing agreements primarily related to the financing of certain store fixtures. As of February 1, 2014, $8

million is included in the amounts above.

The fair value of long-term debt is determined by using model-derived valuations in which all significant inputs

or significant value-drivers are observable in active markets and therefore is classified as Level 2.

The carrying values of cash and cash equivalents, short-term investments, and other current receivables and payables

approximate their fair value.

59