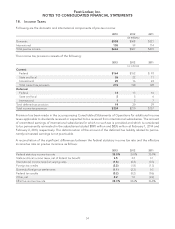

Foot Locker 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foot Locker, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

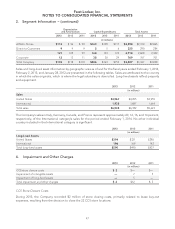

4. Impairment and Other Charges − (continued)

Impairment of Intangible Assets

Intangible assets that are determined to have finite lives are amortized over their useful lives and are measured

for impairment only when events or changes in circumstances indicate that the carrying value may be impaired.

Intangible assets with indefinite lives are tested for impairment if impairment indicators arise and, at a minimum,

annually. We estimate the fair value based on an income approach using the relief-from-royalty method. During

the fourth quarters of 2012 and 2011, the Company determined that triggering events had occurred related to

its CCS intangible assets, which is part of the Direct-to-Customers segment, reflecting decreases in projected

revenues. The 2012 charge also reflected a decrease in the assumed royalty rate as a result of lower profitability.

No impairment charges related to intangible assets were recorded during 2013.

Impairment of Long-lived Assets

During 2012, the Company recorded non-cash impairment charges totaling $5 million to write-down long-lived

assets at its CCS division. This impairment charge was recorded to fully impair the CCS stores net book value

as a result of the Company’s decision to close all 22 of its locations during 2013.

5. Other Income

Other income includes non-operating items, such as: gains from insurance recoveries; discounts/premiums

paid on the repurchase and retirement of bonds; royalty income; and the changes in fair value, premiums paid,

and realized gains associated with foreign currency option contracts. Other income was $4 million in 2013, $2

million in 2012, and $4 million in 2011.

For 2013, other income includes $2 million of royalty income and $2 million of lease termination gains related

to the sales of leasehold interests. For 2012, other income primarily includes royalty income. For 2011, other

income primarily includes $2 million of lease termination gains related to the sales of leasehold interests,

$1 million for insurance recoveries, as well as royalty income.

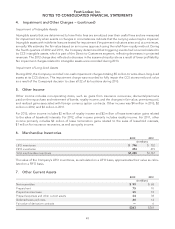

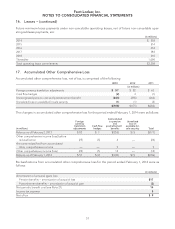

6. Merchandise Inventories

2013 2012

(in millions)

LIFO inventories $ 746 $ 752

FIFO inventories 474 415

Total merchandise inventories $1,220 $1,167

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as calcu-

lated on a FIFO basis.

7. Other Current Assets

2013 2012

(in millions)

Net receivables $99 $68

Prepaid rent 75 70

Prepaid income taxes 35 72

Prepaid expenses and other current assets 34 38

Deferred taxes and costs 20 14

Fair value of derivative contracts —6

$263 $268

48