Albertsons 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

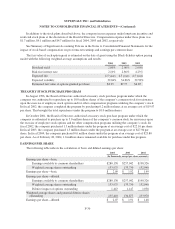

The expected long-term rate of return for Plan assets was determined based on the projection of asset class

return expectations applied to the target asset allocation of the Plan assets. Consideration was given to widely-

accepted capital market principles, long-term return analysis for global fixed income and equity markets, the

active total return oriented portfolio management style as well as the diversification needs and rebalancing

characteristics of the Plan. Long-term trends were evaluated relative to market factors such as inflation, interest

rates and fiscal and monetary polices in order to assess the capital market assumptions.

The company expects to contribute approximately $25 million to its defined benefit pension plans during

fiscal 2005.

SHAREHOLDER RIGHTS PLAN

On April 24, 2000, the company announced that the Board of Directors adopted a Shareholder Rights Plan

under which one preferred stock purchase right is distributed for each outstanding share of common stock. The

rights, which expire on April 12, 2010, are exercisable only under certain conditions, and may be redeemed by

the Board of Directors for $0.01 per right. The plan contains a three-year independent director evaluation

provision whereby a committee of the company’s independent directors will review the plan at least once every

three years. The rights become exercisable, with certain exceptions, after a person or group acquires beneficial

ownership of 15 percent or more of the outstanding voting stock of the company.

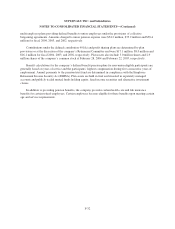

SUBSEQUENT EVENTS

On April 1, 2004, the company completed the sale of its minority ownership interest in WinCo Foods, Inc.,

a privately-held regional grocery chain that operates stores in Idaho, Oregon, Nevada, Washington and

California. The company received after-tax proceeds of approximately $150 million on the sale.

On May 3, 2004, the company utilized the proceeds from the sale of its minority interest in WinCo and

additional available cash balances to voluntarily redeem $250 million of 7

5

⁄

8

percent Notes due September 15,

2004, in accordance with the Note redemption provisions.

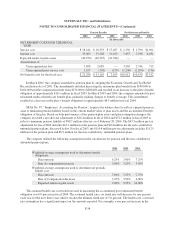

SEGMENT INFORMATION

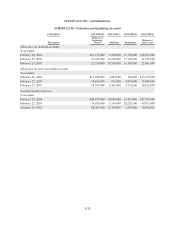

Refer to page F-5 for the company’s segment information.

F-36