Albertsons 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net Interest Expense

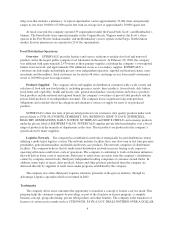

Interest expense was $165.6 million in fiscal 2004 compared with $182.5 million last year. The decrease

primarily reflects lower borrowing levels that more than offset $5.8 million in pre-tax costs related to the early

redemption of $100 million of debt at a price of 103.956 percent in the third quarter of fiscal 2004. Interest

income was $19.1 million in fiscal 2004 compared with $20.6 million last year.

Income Taxes

The effective tax rate was 38.4 percent and 37.0 percent in fiscal 2004 and fiscal 2003, respectively. The

increase in the effective tax rate in the current year was due to $7.6 million of taxes due on the Asset Exchange.

Net Earnings

Net earnings were $280.1 million, or $2.07 per diluted share, in fiscal 2004 compared with net earnings of

$257.0 million, or $1.91 per diluted share last year.

Weighted average diluted shares increased to 135.4 million fiscal 2004 compared with 134.9 million shares

last year, reflecting the net impact of stock option activity and shares repurchased under the treasury stock

program.

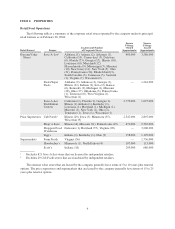

Comparison of fifty-two weeks ended February 22, 2003 (2003) with fifty-two weeks ended February 23,

2002 (2002):

Net Sales

Net sales for 2003 were $19.2 billion, a decrease of 5.6 percent from 2002. Retail food sales were 51.4

percent of net sales for 2003 compared with 47.1 percent for 2002. Food distribution sales were 48.6 percent of

net sales for 2003 compared with 52.9 percent for 2002.

Retail food sales for 2003 increased 3.1 percent compared to 2002, primarily as a result of new store growth.

Same-store retail sales for 2003 were negative 1.1 percent, impacted by approximately 1.2 percent of planned in-

market expansion. Other factors contributing to the decline in same store sales performance include a weakened

economy and a more intense promotional environment.

Fiscal 2003 store activity, including licensed units, resulted in 198 new stores opened and acquired,

including the acquisition of 50 Deals stores and 41 stores closed or sold for a total of 1,417 stores at year end.

Total square footage increased approximately 6.6 percent over the prior year.

Food distribution sales for 2003 decreased 13.3 percent compared to 2002, primarily reflecting customers

lost in 2002 including the exit of the Kmart supply contract and the loss of Genuardi’s as a customer and sales

losses from restructure activities, which accounted for approximately eight percent, three percent and one

percent, respectively, of the decrease in food distribution sales.

Gross Profit

Gross profit (calculated as net sales less cost of sales), as a percentage of net sales, was 13.5 percent for

2003 compared to 12.8 percent for 2002. The increase in gross profit, as a percentage of net sales, reflects the

growing proportion of the company’s retail food business, which operates at a higher gross profit margin as a

percentage of net sales than does the food distribution business, including the higher gross profit margin of the

recently acquired and opened Deals stores. Gross profit in retail benefited from improved merchandising

execution. Gross profit in distribution was negatively impacted by a change in our distribution customer mix.

14