Albertsons 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

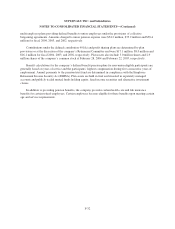

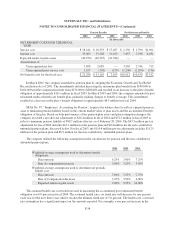

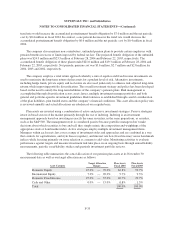

multi-employer plans providing defined benefits to union employees under the provisions of collective

bargaining agreements. Amounts charged to union pension expense were $34.2 million, $35.2 million and $38.4

million for fiscal 2004, 2003, and 2002, respectively.

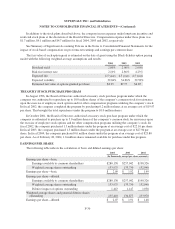

Contributions under the defined contribution 401(k) and profit sharing plans are determined by plan

provisions or at the discretion of the company’s Retirement Committee and were $17.1 million, $8.0 million and

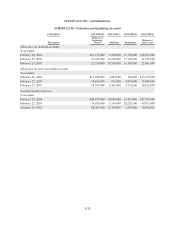

$16.1 million for fiscal 2004, 2003, and 2002, respectively. Plan assets also include 3.0 million shares and 2.9

million shares of the company’s common stock at February 28, 2004 and February 22, 2003, respectively.

Benefit calculations for the company’s defined benefit pension plans for non-union eligible participants are

generally based on years of service and the participants’ highest compensation during five consecutive years of

employment. Annual payments to the pension trust fund are determined in compliance with the Employee

Retirement Income Security Act (ERISA). Plan assets are held in trust and invested in separately managed

accounts and publicly traded mutual funds holding equity, fixed income securities and alternative investment

classes.

In addition to providing pension benefits, the company provides certain health care and life insurance

benefits for certain retired employees. Certain employees become eligible for these benefits upon meeting certain

age and service requirements.

F-32