Albertsons 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$26.4 million to reflect a minimum pension liability of $98.7 million after-tax as of February 28, 2004. This other

comprehensive loss adjustment was a non-cash reduction of equity and did not impact earnings. This other

comprehensive loss adjustment will be revised in future years depending upon market performance and interest

rate levels.

The company’s capital budget for fiscal 2005, which includes capitalized leases, is projected at

approximately $400.0 million to $425.0 million, compared with actual spending of $371.5 million in fiscal 2004.

The capital budget for 2005 anticipates cash spending of $340.0 million to $365.0 million, in addition to $60.0

million for capital leases. Approximately $300.0 million of the fiscal 2005 budget has been identified for use in

the company’s retail food business and includes approximately eight to 10 regional banner stores and

approximately 110 to 140 new extreme value stores, including extreme value general merchandise combination

stores and approximately 30 regional banner major store remodels. The balance of the fiscal 2005 capital budget

relates to distribution maintenance capital and information technology related items. In addition, the company

will continue to support store development and financing for the company’s independent retailers. Certain

retailer financing activities may not require new cash outlays because they involve leases or guarantees. The

capital budget does include amounts for projects which are subject to change and for which firm commitments

have not been made.

Cash dividends declared during fiscal 2004, 2003, and 2002 totaled $0.5775, $0.5675 and $0.5575 per

common share, respectively. The company’s dividend policy will continue to emphasize a high level of earnings

retention for growth.

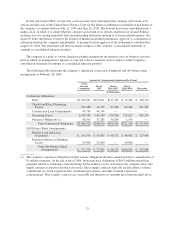

COMMITMENTS, CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENTS

The company has guaranteed certain leases, fixture financing loans and other debt obligations of various

retailers at February 28, 2004. These guarantees were generally made to support the business growth of affiliated

retailers. The guarantees are generally for the entire term of the lease or other debt obligation with remaining

terms that range from less than one year to twenty-two years, with a weighted average remaining term of

approximately ten years. For each guarantee issued, if the affiliated retailer defaults on a payment, the company

would be required to make payments under its guarantee. Generally, the guarantees are secured by

indemnification agreements or personal guarantees of the affiliated retailer. At February 28, 2004, the maximum

amount of undiscounted payments the company would be required to make in the event of default of all

guarantees was $290.4 million and represented $180.3 million on a discounted basis. No amount has been

accrued for the company’s obligation under its guaranty arrangements. In addition, the company has guaranteed a

construction loan on a warehouse of $1.5 million at February 28, 2004 that the company will purchase upon

completion. The company has evaluated its agreements that contain guarantees and indemnification clauses in

accordance with the guidance of FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others”. As of February 28,

2004, the company did not have any material guarantees that were issued or modified since December 31, 2002.

The company is party to synthetic leasing programs for two of its major warehouses. The leases expire in

September 2004 and April 2008. The lease that expires in September 2004 may be renewed with the lessor’s

consent through September 2006, and has a purchase option of approximately $25 million. The lease that expires

in April 2008 has a purchase option of $60.0 million. At February 28, 2004, the estimated market value of the

properties underlying these leases equaled or exceeded the purchase options. The company’s obligation under its

guaranty arrangements related to these synthetic leases had a carrying balance of $2.8 million, which is a

component of “other liabilities” in the accompanying Consolidated Balance Sheet at February 28, 2004.

The company had $145.7 million of outstanding letters of credit as of February 28, 2004, of which $120.1

million were issued under the credit facility and $25.6 million were issued under separate agreements with

financial institutions. These letters of credit primarily support workers’ compensation, merchandise import

programs and payment obligations. The company pays fees, which vary by instrument, of up to 1.125% on the

outstanding balance of the letter credit.

24