Albertsons 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

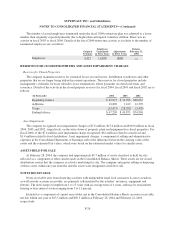

reserve increase of $11.7 million was a result of changes in estimates on employee benefit related costs from

previously exited food distribution facilities and changes in estimates on exited real estate in certain markets for

food distribution properties.

Included in the asset impairment charges in fiscal 2001 of $89.7 million were $57.4 million of charges

related to retail food properties and $32.3 million of charges related to food distribution properties. Writedowns

for property, plant and equipment, goodwill and other intangibles, and other assets were $58.4 million, $21.8

million and $9.5 million, respectively, and were reflected in the “Restructure and other charges” line in the

Consolidated Statements of Earnings for fiscal 2001. In fiscal 2003, the fiscal 2001 asset impairment charges for

property, plant and equipment were decreased by $3.6 million primarily due to changes in estimates on exited

real estate in certain markets and includes a decrease of $8.2 million in estimates related to certain food

distribution properties offset by an increase of $4.6 million in estimates related to certain retail food properties.

In fiscal 2004, the fiscal 2001 asset impairment charges for property, plant and equipment were increased by $2.7

million primarily due to changes in estimates on exited real estate in certain markets for food distribution

properties. The impairment charges reflect the difference between the carrying value of the assets and the

estimated fair values, which were based on the estimated market values for similar assets.

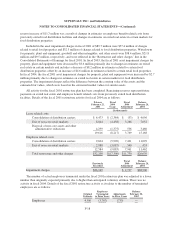

All activity for the fiscal 2001 restructure plan has been completed. Remaining reserves represent future

payments on exited real estate and employee benefit related costs from previously exited food distribution

facilities. Details of the fiscal 2001 restructure activity for fiscal 2004 are as follows:

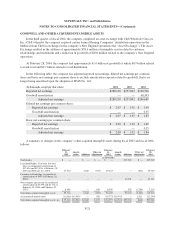

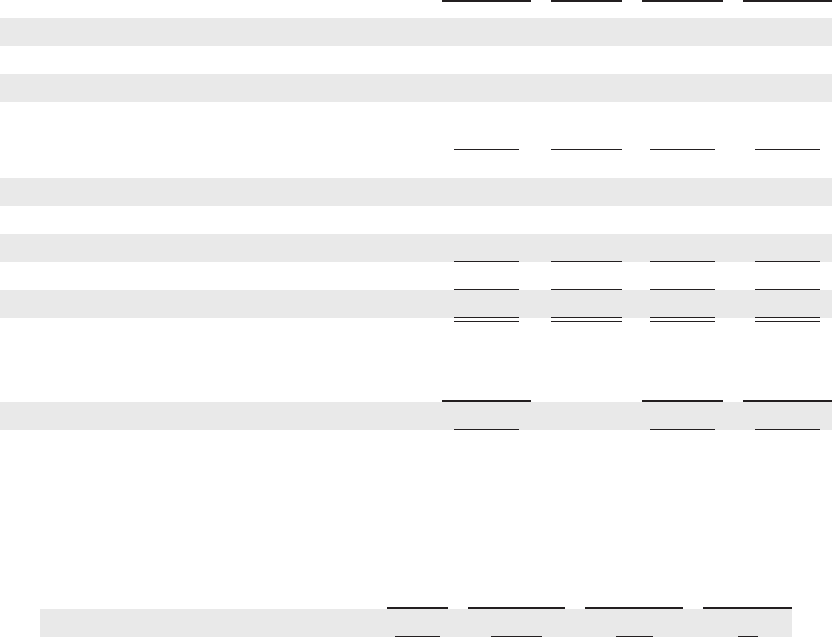

Balance

February 22,

2003

Fiscal

2004

Usage

Fiscal

2004

Adjustment

Balance

February 28,

2004

(In thousands)

Lease related costs:

Consolidation of distribution centers $ 6,473 $ (2,384) $ (33) $ 4,056

Exit of non-core retail markets 8,844 (4,458) 3,266 7,652

Disposal of non-core assets and other

administrative reductions 4,299 (1,375) 536 3,460

19,616 (8,217) 3,769 15,168

Employee related costs:

Consolidation of distribution centers 9,604 (5,996) 7,421 11,029

Exit of non-core retail markets 2,980 (3,087) 540 433

12,584 (9,083) 7,961 11,462

Total restructure and other charges $32,200 $(17,300) $11,730 $26,630

Previously

Recorded

Fiscal

2004

Adjustment

Balance

February 28,

2004

Impairment charges $86,169 $ 2,737 $88,906

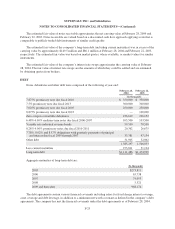

The number of actual employees terminated under the fiscal 2001 restructure plan was adjusted to a lower

number than originally expected primarily due to higher than anticipated voluntary attrition. There was no

activity in fiscal 2004. Details of the fiscal 2001 restructure activity as it relates to the number of terminated

employees are as follows:

Original

Estimate

Employees

Terminated

in Prior Years

Adjustments

in Prior Years

Balance

February 22,

2003

Employees 4,500 (3,767) (733) —

F-18