Albertsons 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

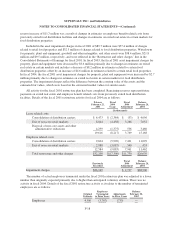

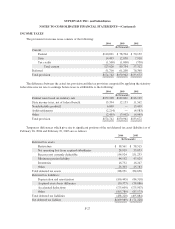

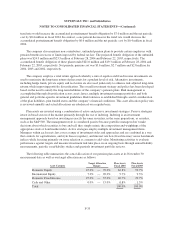

Future minimum receivables under operating leases and subleases in effect at February 28, 2004 are as

follows: Owned

Property

Leased

Property Total

(In thousands)

Fiscal Year

2005 $1,496 $ 22,971 $ 24,467

2006 1,450 19,388 20,838

2007 1,113 16,583 17,696

2008 1,069 13,026 14,095

2009 526 9,025 9,551

Later 470 38,039 38,509

Total future minimum receivables $6,124 $119,032 $125,156

Owned property leased to third parties is as follows:

February 28,

2004

February 22,

2003

(In thousands)

Land, buildings and equipment $16,839 $19,161

Less accumulated depreciation 8,056 7,171

Net land, buildings and equipment $ 8,783 $11,990

The company recognizes rent escalations on a straight-line basis over the term of the lease. Deferred rents

are included in other liabilities in the Consolidated Balance Sheets.

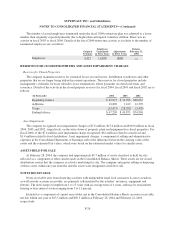

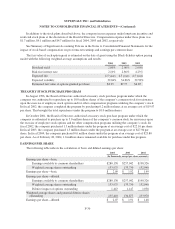

Direct financing leases:

Under direct financing capital leases, the company leases buildings on behalf of independent retailers with

terms ranging from 5 to 20 years. Future minimum rentals to be received under direct financing leases and

related future minimum obligations under capital leases in effect at February 28, 2004, are as follows:

Direct

Financing

Lease

Receivables

Direct

Financing

Capital Lease

Obligations

(In thousands)

Fiscal Year

2005 $ 13,239 $ 12,473

2006 12,163 11,470

2007 11,523 10,935

2008 10,498 9,923

2009 9,742 9,223

Later 56,879 54,366

Total minimum lease payments 114,044 108,390

Less unearned income 38,223 —

Less interest — 35,831

Present value of net minimum lease payments 75,821 72,559

Less current portion 7,133 7,178

Long-term portion $ 68,688 $ 65,381

F-26