Albertsons 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

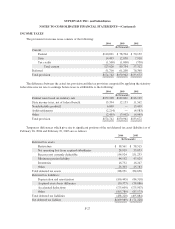

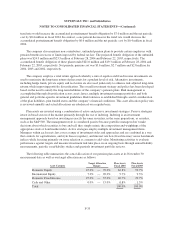

INCOME TAXES

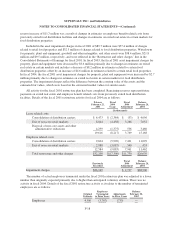

The provision for income taxes consists of the following:

2004 2003 2002

(In thousands)

Current

Federal $110,031 $ 78,704 $ 50,152

State 14,495 12,050 7,910

Tax credits (1,500) (1,000) (750)

Total current 123,026 89,754 57,312

Deferred 51,716 61,208 76,360

Total provision $174,742 $150,962 $133,672

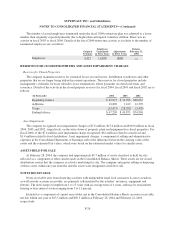

The difference between the actual tax provision and the tax provision computed by applying the statutory

federal income tax rate to earnings before taxes is attributable to the following:

2004 2003 2002

(In thousands)

Federal taxes based on statutory rate $159,208 $142,801 $116,199

State income taxes, net of federal benefit 13,394 12,153 11,562

Nondeductible goodwill 6,809 — 15,439

Audit settlements (2,214) — (4,583)

Other (2,455) (3,992) (4,945)

Total provision $174,742 $150,962 $133,672

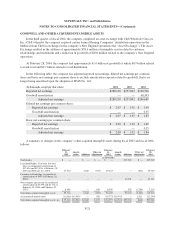

Temporary differences which give rise to significant portions of the net deferred tax asset (liability) as of

February 28, 2004 and February 22, 2003 are as follows:

2004 2003

(In thousands)

Deferred tax assets:

Restructure $ 38,561 $ 58,515

Net operating loss from acquired subsidiaries 28,919 35,853

Reserves not currently deductible 154,524 151,233

Minimum pension liability 64,192 47,025

Inventories 16,732 16,247

Other 25,303 25,783

Total deferred tax assets 328,231 334,656

Deferred tax liabilities:

Depreciation and amortization (106,445) (84,318)

Acquired assets basis difference (50,377) (58,886)

Accelerated deductions (175,609) (175,507)

Other (105,789) (87,173)

Total deferred tax liabilities (438,220) (405,884)

Net deferred tax liability $(109,989) $ (71,228)

F-27