Albertsons 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

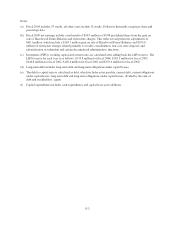

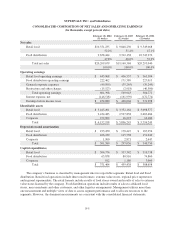

SUPERVALU INC. and Subsidiaries

FIVE YEAR FINANCIAL AND OPERATING SUMMARY

2004 2003 2002 2001 2000(b)

Statement of Earnings

Data (a)

Net sales $20,209,679 $19,160,368 $20,293,040 $22,520,384 $19,675,782

Cost of sales 17,372,429 16,567,397 17,704,197 19,976,436 17,450,060

Selling and administrative

expenses 2,220,329 2,020,110 2,037,771 2,042,259 1,705,003

Gain on sale of Hazelwood

Farms Bakeries ————163,662

Restructure and other charges 15,523 2,918 46,300 171,264 103,596

Operating earnings 601,398 569,943 504,772 330,425 580,785

Interest, net 146,518 161,939 172,774 190,835 135,392

Earnings before taxes 454,880 408,004 331,998 139,590 445,393

Provision for income taxes 174,742 150,962 133,672 66,720 203,703

Net earnings 280,138 257,042 198,326 72,870 241,690

Net earnings per common

share—diluted 2.07 1.91 1.48 0.55 1.86

Balance Sheet Data (a)

Inventories (FIFO) (c) $ 1,214,122 $ 1,194,791 $ 1,178,817 $ 1,477,180 $ 1,622,151

Working capital (c) 300,899 288,572 36,031 (125,408) (197,599)

Net property, plant and

equipment 2,134,436 2,220,850 2,208,633 2,232,794 2,168,210

Total assets 6,152,938 5,896,245 5,796,249 6,343,152 6,493,292

Long-term debt (d) 1,633,721 2,019,658 1,875,873 2,008,474 1,953,741

Stockholders’ equity 2,209,574 2,009,240 1,899,138 1,783,149 1,820,228

Other Statistics (a)

Net earnings as a percent of net

sales 1.39% 1.34% 0.98% 0.32% 1.23%

Return on average

stockholders’ equity 13.29% 12.97% 10.70% 3.96% 14.80%

Book value per common share $ 16.40 $ 15.03 $ 14.29 $ 13.47 $ 13.52

Current ratio (c) 1.16:1 1.19:1 1.02:1 0.95:1 0.92:1

Debt to capital ratio (e) 46.7% 51.8% 54.3% 59.7% 60.0%

Dividends declared per

common share $ 0.57¾ $ 0.56¾ $ 0.55¾ $ 0.54¾ $ 0.53¾

Weighted average common

shares outstanding—diluted 135,418 134,877 133,978 132,829 130,090

Depreciation and amortization $ 301,589 $ 297,056 $ 340,750 $ 343,779 $ 277,062

Capital expenditures (f) $ 371,464 $ 439,438 $ 388,658 $ 511,673 $ 539,264

Net cash provided by operating

activities $ 832,206 $ 587,604 $ 692,542 $ 611,804 $ 345,230

Net cash used in investing

activities $ (256,984) $ (334,717) $ (224,707) $ (357,179) $ (516,796)

Net cash used in financing

activities $ (312,454) $ (235,870) $ (466,060) $ (255,149) $ (174,878)

F-2