Albertsons 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

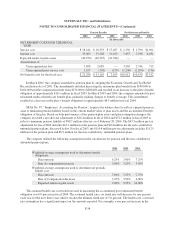

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

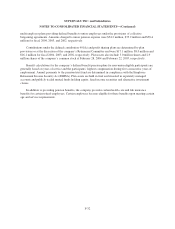

In November 2003, the company voluntarily redeemed $100.0 million of its 8.875% notes due in 2022 at a

redemption price of 103.956% of the principal amount of the notes.

In August 2003, the company renewed its annual accounts receivable securitization program, under which

the company can borrow up to $200.0 million on a revolving basis, with borrowings secured by eligible accounts

receivable. Outstanding borrowings under this program at February 28, 2004 and February 22, 2003, were $0 and

$80.0 million, respectively, and are components of notes payable in the Consolidated Balance Sheets. The

average short-term interest rate was 1.32% for fiscal 2004.

In May 2002, the company completed the issuance of the $300.0 million 10-year 7.50% Senior Notes. A

portion of the proceeds was used to redeem the company’s 9.75% Senior Notes due fiscal 2005 on June 17, 2002.

In November 2002, the company also retired $300.0 million 7.80% Notes that matured.

In April 2002, the company finalized a three-year, unsecured $650.0 million revolving credit agreement

with rates tied to LIBOR plus 0.650 to 1.400 percent, based on the company’s credit ratings. The agreement

contains various financial covenants including ratios for fixed charge interest coverage, asset coverage and debt

leverage, in addition to a minimum net worth covenant. The company had no outstanding borrowings under the

credit facilities at February 28, 2004 and February 22, 2003. As of February 28, 2004, letters of credit

outstanding under the credit facility were $120.1 million and the unused available credit under the facility was

$529.9 million.

In November 2001, the company sold zero-coupon convertible debentures having an aggregate principal

amount at maturity of $811.0 million. The proceeds from the offering, net of approximately $5.0 million of

expenses, were $208.0 million. The debentures mature in 30 years and are callable at the company’s option on or

after October 1, 2006. Holders may require the company to purchase all or a portion of their debentures on

October 1, 2003, October 1, 2006 or October 1, 2011 at a purchase price equal to the accreted value of the

debentures, which includes accrued and unpaid cash interest. If the option is exercised, the company has the

choice of paying the holder in cash, common stock or a combination of the two. On October 1, 2003, none of the

holders exercised this option. The debentures will generally be convertible if the closing price of the company’s

common stock on the New York Stock Exchange for twenty of the last thirty trading days of any fiscal quarter

exceeds certain levels, at $36.58 per share for the quarter ending June 19, 2004, and rising to $113.29 per share at

September 6, 2031. In the event of conversion, 9.6434 shares of the company’s common stock will be issued per

$1,000 debenture. The debentures have an initial yield to maturity of 4.5%, which is being accreted over the life

of the debentures using the effective interest method. The company may pay contingent cash interest for the six-

month period commencing November 3, 2006 and for any six-month period thereafter if the average market price

of the debentures for a five trading day measurement period preceding the applicable six-month period equals

120% or more of the sum of the issue price and accrued original issue discount for the debentures. The

debentures are classified as long-term debt based on the company’s ability and intent to refinance the obligation

with long-term debt if the company is required to repurchase the debentures.

See Subsequent Events note on page F-36 in the Notes to Consolidated Financial Statements.

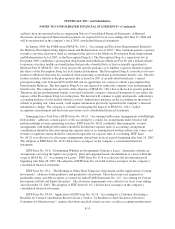

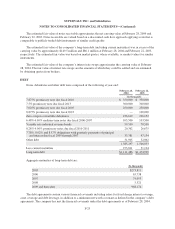

LEASES

Capital and operating leases:

The company leases certain retail food stores, food distribution warehouses and office facilities. Many of

these leases include renewal options, and to a limited extent, include options to purchase. Amortization of assets

under capital leases was $35.1 million, $32.8 million and $31.6 million in fiscal 2004, 2003 and 2002,

respectively.

F-24