Albertsons 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

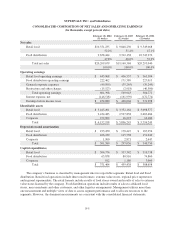

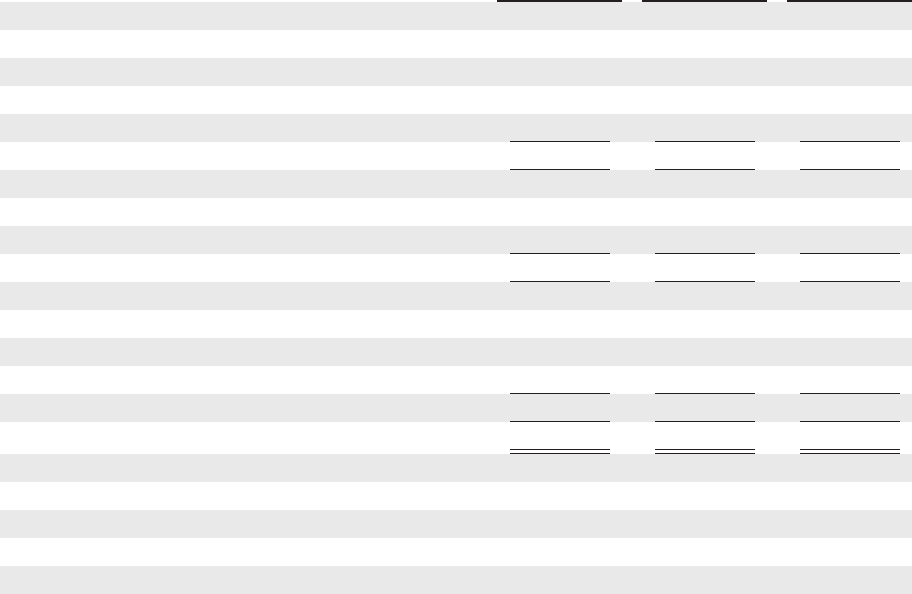

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF EARNINGS

(In thousands, except per share data)

February 28, 2004

(53 weeks)

February 22, 2003

(52 weeks)

February 23, 2002

(52 weeks)

Net sales $20,209,679 $19,160,368 $20,293,040

Costs and expenses

Cost of sales 17,372,429 16,567,397 17,704,197

Selling and administrative expenses 2,220,329 2,020,110 2,037,771

Restructure and other charges 15,523 2,918 46,300

Operating earnings 601,398 569,943 504,772

Interest

Interest expense 165,581 182,499 194,294

Interest income 19,063 20,560 21,520

Interest expense, net 146,518 161,939 172,774

Earnings before income taxes 454,880 408,004 331,998

Provision for income taxes

Current 123,026 89,754 57,312

Deferred 51,716 61,208 76,360

Income tax expense 174,742 150,962 133,672

Net earnings $ 280,138 $ 257,042 $ 198,326

Weighted average number of common shares outstanding

Diluted 135,418 134,877 133,978

Basic 133,975 133,730 132,940

Net earnings per common share—diluted $ 2.07 $ 1.91 $ 1.48

Net earnings per common share—basic $ 2.09 $ 1.92 $ 1.49

See notes to consolidated financial statements.

F-6