Albertsons 2004 Annual Report Download - page 16

Download and view the complete annual report

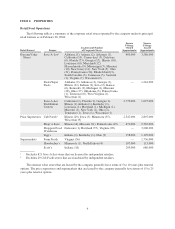

Please find page 16 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 6. SELECTED FINANCIAL DATA

The information called for by Item 6 is found within the Five Year Financial and Operating Summary on

page F-2.

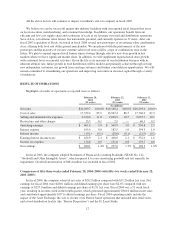

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

SUPERVALU is one of the largest grocery companies in the United States. We operate within two

complementary businesses in the grocery food industry, grocery retail and food distribution. At February 28,

2004, we conducted our retail operations through a total of 1,483 stores, including 821 licensed locations.

Principal formats include extreme value stores, regional price superstores and regional supermarkets. Our food

distribution operations network spans 48 states and we serve as primary grocery supplier to approximately 2,470

stores, in addition to our own regional banner store network, as well as serving as secondary grocery supplier to

approximately 660 stores.

For the past several years, the approximate $500 billion revenue grocery food industry has been

consolidating. As a result, market share has been concentrated in the larger grocery food companies. We

participated in that consolidation through selective acquisition activities and the exit of certain markets. Based on

revenues today, we would be ranked as the largest extreme value food retailer, 11th largest grocery retailer, and

largest public company food wholesaler in the United States.

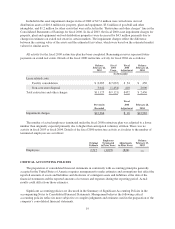

In addition to consolidation activities, the grocery industry has experienced store saturation driven primarily

by the continued increase in square footage devoted to food in supercenters, club stores, mass merchandisers,

dollar stores, drug stores and other alternate formats as well as organic growth by traditional supermarket

operators. As a result, same-store sales growth for the industry has been soft, pressuring profitability levels in the

industry as operating costs continue to rise at a rate faster than sales growth. We expect this industry environment

to continue for the foreseeable future.

In fiscal 2004, our businesses benefited from the bankruptcy of Fleming Companies, Inc., formerly one of

our largest food wholesale competitors. By entering into an asset exchange with C&S, we were able to affiliate

certain former Fleming distribution operations in the Midwest in exchange for our New England operations.

Even though overall revenues declined, approximately $200 million on an annual basis, as a result of the Asset

Exchange, the efficiencies of our remaining operations were greatly enhanced as volume was concentrated in our

existing facilities. It is expected that this transaction will provide incremental net earnings per share in fiscal

2005 of $.07 to $.10 per share.

The grocery industry is also affected by the general economic environment and its impact on consumer

spending behavior. In fiscal 2003, we experienced moderate deflation in our product costs in a weak economic

environment. We would characterize fiscal 2004 as a year with a modestly improving economy and more normal

levels of consumer spending and product cost inflation. For fiscal 2005, we expect a modest inflationary

environment and further economic recovery.

In fiscal 2004, most US businesses, including the labor intensive grocery industry were impacted by another

year of rapidly rising health care and pension costs. These rising costs impacted the overall profitability levels of

the food industry and have become a pivotal issue in labor negotiations for unionized employees who bargain for

health and retirement benefits in addition to wages. Approximately 42% of SUPERVALU’s employees are

unionized. In the St. Louis market, where we operate 21 regional supermarkets, we experienced a 28-day strike in

the third quarter of fiscal 2004 (the “St. Louis Strike”). Approximately 40% of our unionized workforce are

represented by contracts that are up for renewal in fiscal 2005.

All of these industry factors impact our food distribution customer base. As a result, we continue to

experience revenue attrition in our food distribution operations in a historical range of approximately 2% to 4%.

11