Albertsons 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

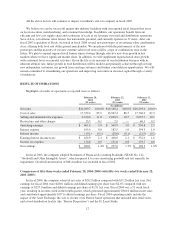

Fiscal 2004 net cash outflows relating to all restructure plans were approximately $20 million. Remaining

future net cash outflows primarily relate to expected net future payments on exited real estate and employee

related costs, net of after-tax proceeds from the sale of owned properties. Cash outflows will be funded by cash

from operations.

Restructure 2002

In fiscal 2002, the company identified additional efforts that would allow it to extend its food distribution

efficiency program that began early in fiscal 2001. The additional food distribution efficiency initiatives

identified resulted in pre-tax restructure charges of $16.3 million, primarily related to personnel reductions in

administrative and transportation functions. Management began the initiatives in fiscal 2003 and the majority of

these actions were completed by the end of fiscal 2003.

In fiscal 2003, the fiscal 2002 restructure charges were decreased by $3.6 million, including a decrease of

$1.4 million due to lower than anticipated lease related costs in transportation efficiency initiatives and a

decrease of $2.2 million in employee related costs due to lower than anticipated severance costs.

In fiscal 2004, the fiscal 2002 restructure charges were increased by $0.6 million due to higher than

anticipated severance costs for certain employees.

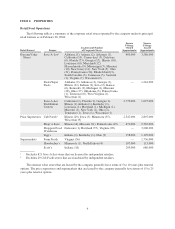

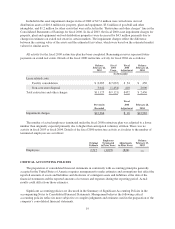

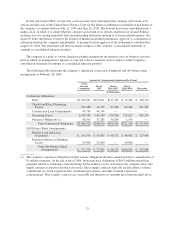

Remaining reserves for the fiscal 2002 restructure plan represent future lease payments. Details of the fiscal

2002 restructure activity for fiscal 2004 are as follows:

Balance

February 22,

2003

Fiscal

2004

Usage

Fiscal 2004

Adjustment

Balance

February 28,

2004

(In thousands)

Lease related costs:

Transportation efficiency initiatives $1,054 $ (816) $ (43) $195

1,054 (816) (43) 195

Employee related costs:

Administrative realignment 2,390 (3,019) 629 —

2,390 (3,019) 629 —

Total restructure charges $3,444 $(3,835) $586 $195

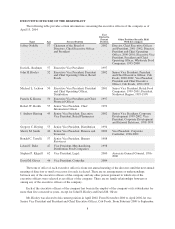

Details of the fiscal 2002 restructure activity as it relates to the number of terminated employees are as

follows:

Original

Estimate

Employees

Terminated

in Fiscal 2003

Balance

February 22,

2003

Employees

Terminated

in Fiscal 2004

Balance

February 28,

2004

Employees 800 (650) 150 (150) —

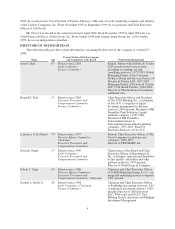

Restructure 2001

In fiscal 2001, the company completed a strategic review that identified certain assets that did not meet

return objectives, provide long-term strategic opportunities or justify additional capital investments. This review

process culminated in the company recording pre-tax restructure and other charges of $181.6 million, including

$89.7 million for asset impairment charges, $52.1 million for lease subsidies, lease cancellation fees, future

payments on exited real estate and guarantee obligations and $39.8 million for severance and employee related

costs.

In fiscal 2002, the fiscal 2001 restructure and other charges were increased by $17.8 million as a result of

changes in estimates primarily due to the softening real estate market, including $19.1 million for increased lease

liabilities in exiting the non-core retail markets and the disposal of non-core assets, offset by a net decrease of

$1.3 million in restructure reserves for the consolidation of distribution centers.

16