Albertsons 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling and Administrative Expenses

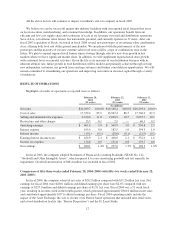

Selling and administrative expenses, as a percentage of net sales, were 10.5 percent for 2003 compared to

10.1 percent for 2002. Selling and administrative expenses include $12.5 million in store closing reserves

recorded in fiscal 2002. Fiscal 2002 also includes goodwill amortization of $48.4 million. The increase in selling

and administrative expenses, as a percentage of net sales, reflects the growing proportion of the company’s retail

food business, which operates at a higher selling and administrative expense as a percentage of net sales than

does the food distribution business, including the higher selling and administrative expense ratio of the recently

acquired and opened Deals stores.

Operating Earnings

The company’s operating earnings were $569.9 million for 2003 compared to $504.8 million for 2002, a

12.9 percent increase. Fiscal 2003 operating earnings include $2.9 million for restructure and other charges.

Fiscal 2002 operating earnings include $46.3 million for restructure and other charges and $12.5 million in store

closing reserves. Retail food 2003 operating earnings increased 20.2 percent to $436.5 million, or 4.4 percent of

net sales, from 2002 operating earnings of $363.3 million, or 3.8 percent of net sales. Fiscal 2002 retail food

operating earnings include goodwill amortization of $25.3 million. The remaining increase in retail food

operating earnings was primarily due to growth of new stores and improved merchandising execution in retail.

Food distribution 2003 operating earnings decreased 24.4 percent to $171.6 million, or 1.8 percent of net sales,

from 2002 operating earnings of $227.0 million, or 2.1 percent of net sales. Fiscal 2002 food distribution

operating earnings included goodwill amortization of $23.1 million. The decrease in food distribution operating

earnings primarily reflects the decrease in sales volume and a change in our distribution customer mix.

Net Interest Expense

Interest expense decreased to $182.5 million in 2003 compared with $194.3 million in 2002, reflecting

lower borrowing levels and lower average interest rates, largely due to the interest rate swap agreements entered

into in 2003. Interest income decreased to $20.6 million in 2003 compared with $21.5 million in 2002.

Income Taxes

The effective tax rate was 37.0 percent in 2003 compared with 40.3 percent in 2002. The decrease in the

effective tax rate was due to the discontinuation of goodwill amortization as of February 24, 2002, which is not

deductible for income tax purposes.

Net Earnings

Net earnings were $257.0 million, or $1.91 per diluted share, in 2003 compared with net earnings of $198.3

million, or $1.48 per diluted share in 2002.

Weighted average diluted shares increased to 134.9 million in 2003 compared with 2002 weighted average

diluted shares of 134.0 million, reflecting the net impact of stock option activity and shares repurchased under

the treasury stock program.

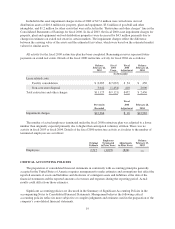

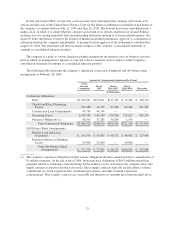

RESTRUCTURE AND OTHER CHARGES

For fiscal 2004, the company recognized pre-tax restructure and other charges of $15.5 million. The charges

reflect the net adjustments to the restructure reserves and asset impairment charges of $0.6 million, $14.4 million

and $0.5 million for restructure 2002, 2001 and 2000, respectively. The increases are due to continued softening

of real estate in certain markets and higher than anticipated employee benefit related costs.

The following information includes only those restructure and other charges that are the result of previously

initiated restructure activities. In addition, the company maintains reserves and has recorded certain impairments

for properties that have been closed as part of management’s ongoing operating decisions. Those reserves and

impairment charges are disclosed within the Reserves for Closed Properties and Asset Impairment section.

15