Albertsons 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

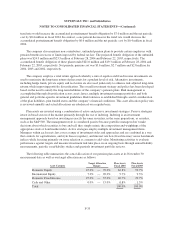

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

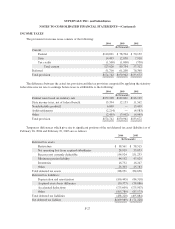

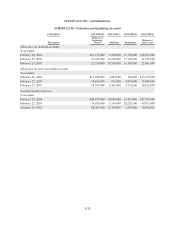

Pension Benefits Post Retirement Benefits

2004 2003 2002 2004 2003 2002

(In thousands)

NET BENEFIT COSTS FOR THE FISCAL

YEAR

Service cost $ 18,242 $ 18,333 $ 17,487 $ 1,350 $ 1,790 $1,902

Interest cost 35,003 33,228 31,163 7,457 7,336 6,031

Expected return on plan assets (40,970) (40,323) (41,386) — — —

Amortization of:

Unrecognized net loss 7,898 2,085 — 3,305 2,744 715

Unrecognized prior service cost 1,107 (158) (159) (1,200) (1,200) (736)

Net benefit costs for the fiscal year $ 21,280 $ 13,165 $ 7,105 $10,912 $10,670 $7,912

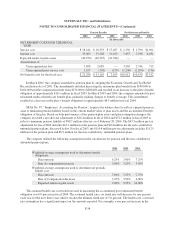

In March 2002, the company amended its pension plan by adopting the Economic Growth and Tax Relief

Reconciliation Act of 2001. The amendments included increasing the maximum plan benefit from $140,000 to

$160,000 and the compensation limit from $170,000 to $200,000 and resulted in an increase to the plan’s benefit

obligation of approximately $10.1 million in fiscal 2003. In March 2003 and 2004, the company amended its post

retirement medical health care benefit plan, primarily making changes to benefit coverage. This amendment

resulted in a decrease in the plan’s benefit obligation of approximately $4.5 million in fiscal 2004.

SFAS No. 87, “Employers’ Accounting for Pension”, requires the balance sheet to reflect a prepaid pension

asset or minimum pension liability based on the current market value of plan assets and the accumulated benefit

obligation of the plan. Based on both performance of the pension plan assets and plan assumption changes, the

company recorded a net after-tax adjustment of $26.4 million in fiscal 2004 and $72.3 million in fiscal 2003 to

reflect a minimum pension liability of $98.7 million after-tax as of February 28, 2004. The $43.5 million pre-tax

adjustment for fiscal 2004 includes $43.1 million for the pension plan and $0.4 million for the non-contributory,

unfunded pension plans, discussed below. For fiscal 2003, the $119.4 million pre-tax adjustment includes $112.5

million for the pension plan and $6.9 million for the non-contributory, unfunded pension plans.

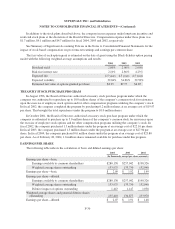

The company utilized the following assumptions in the calculations for pension and the non-contributory

unfunded pension plans:

2004 2003 2002

Weighted-average assumptions used to determine benefit

obligations:

Discount rate 6.25% 7.00% 7.25%

Rate of compensation increase 3.00% 3.25% 3.50%

Weighted-average assumptions used to determine net periodic

benefit cost:

Discount rate 7.00% 7.25% 7.75%

Rate of Compensation Increase 3.25% 3.50% 4.00%

Expected return on plan assets 9.00% 9.25% 10.00%

The assumed health care cost trend rate used in measuring the accumulated post retirement benefit

obligation was 8.0 percent in fiscal 2004. The assumed health care cost trend rate will decrease by one percent

each year for the next three years until it reaches the ultimate trend rate of 5.0 percent. The health care cost trend

rate assumption has a significant impact on the amounts reported. For example, a one percent increase in the

F-34