Albertsons 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On May 3, 2004, the company utilized after-tax WinCo proceeds and additional cash balances to voluntarily

redeem $250 million of 7 5/8 percent Notes due September 15, 2004, in accordance with the note redemption

provisions.

On September 13, 2003, the company acquired certain former Fleming Companies’ distribution operations

in the Midwest pursuant to the Asset Exchange. This transaction had no material impact on liquidity or capital

resources in fiscal 2004. This transaction is expected to contribute to fiscal 2005 earnings per share in the range

of $0.07 to $0.10 on an approximately $200 million lower revenue stream.

In August 2003, the company renewed its annual accounts receivable securitization program, under which

the company can borrow up to $200.0 million on a revolving basis, with borrowings secured by eligible accounts

receivable. Outstanding borrowings under this program at February 28, 2004 and February 22, 2003, were $0 and

$80.0 million, respectively, and are reflected as a component of “notes payable” in the accompanying

Consolidated Balance Sheets. The average short-term interest rate was 1.32% for fiscal 2004.

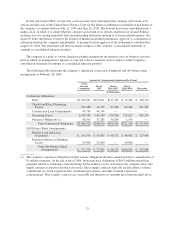

In November 2001, the company sold zero-coupon convertible debentures having an aggregate principal

amount at maturity of $811.0 million. The proceeds from the offering, net of approximately $5.0 million of

expenses, were $208.0 million and were initially used to pay down notes payable and were later used to retire a

portion of the $300.0 million in debt that matured in November 2002. The debentures mature in 30 years and are

callable at the company’s option on or after October 1, 2006. Holders may require the company to purchase all or

a portion of their debentures on October 1, 2003, October 1, 2006 or October 1, 2011 at a purchase price equal to

the accreted value of the debentures, which includes accrued and unpaid cash interest. If the option is exercised,

the company has the choice of paying the holder in cash, common stock or a combination of the two. The

debentures will generally be convertible if the closing price of the company’s common stock on the New York

Stock Exchange for twenty of the last thirty trading days of any fiscal quarter exceeds certain levels, at $36.58

per share for the quarter ending June 19, 2004, and rising to $113.29 per share at September 6, 2031. In the event

of conversion, 9.6434 shares of the company’s common stock will be issued per $1,000 debenture. The

debentures have an initial yield to maturity of 4.5%, which is being accreted over the life of the debentures using

the effective interest method. The company may pay contingent cash interest for the six-month period

commencing November 3, 2006, and for any six-month period thereafter if the average market price of the

debentures for a five trading day measurement period preceding the applicable six-month period equals 120% or

more of the sum of the issue price and accrued original issue discount for the debentures. The debentures are

classified as long-term debt based on the company’s ability and intent to refinance the obligation with long-term

debt if the company is required to repurchase the debentures.

The company is party to synthetic leasing programs for two of its major warehouses. The leases expire in

September 2004 and April 2008. The lease that expires in September 2004 may be renewed with the lessor’s

consent through September 2006, and has a purchase option of approximately $25 million. The lease that expires

in April 2008 may be renewed with the lessor’s consent through April 2013, and has a purchase option of

approximately $60 million.

During fiscal 2004, the company repurchased 0.6 million shares of common stock at an average cost of

$23.80 per share as part of the 5.0 million share repurchase program authorized in fiscal 2003 for employee

compensation-related programs. During fiscal 2003, the company repurchased 1.5 million shares of common

stock at an average cost of $27.94 per share as part of the 5.0 million share repurchase program authorized in

fiscal 2002.

SFAS No. 87, “Employers’ Accounting for Pension”, requires that a prepaid pension asset or minimum

pension liability, based on the current market value of plan assets and the accumulated benefit obligation of the

plan, be reflected. Based on both performance of the pension plan assets and plan assumption changes, the

company recorded a net after-tax other comprehensive loss adjustment in the fourth quarter of fiscal 2004 of

23