Albertsons 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

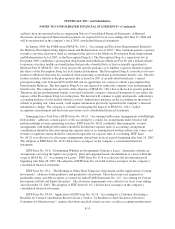

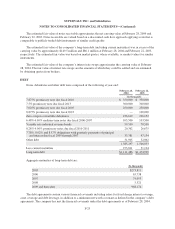

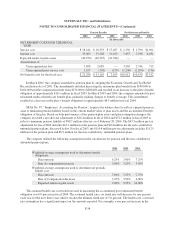

Future minimum obligations under capital leases in effect at February 28, 2004 are as follows:

Lease

Obligations

(In thousands)

Fiscal Year

2005 $ 63,345

2006 62,072

2007 62,209

2008 61,509

2009 58,528

Later 539,825

Total future minimum obligations 847,488

Less interest 365,679

Present value of net future minimum obligations 481,809

Less current obligations 24,955

Long-term obligations $456,854

The present values of future minimum obligations shown are calculated based on interest rates ranging from

6.0 percent to 13.8 percent, with a weighted average rate of 8.1 percent, determined to be applicable at the

inception of the leases.

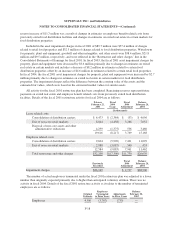

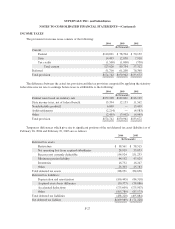

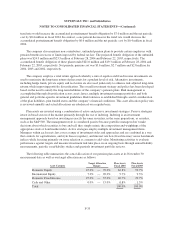

In addition to its capital leases, the company is obligated under operating leases, primarily for buildings,

warehouses and computer equipment. Future minimum obligations under operating leases in effect at February

28, 2004 are as follows:

Operating

Lease

Obligations

(In thousands)

Fiscal Year

2005 $ 160,589

2006 124,290

2007 114,736

2008 94,020

2009 135,802

Later 403,126

Total future minimum obligations $1,032,563

The company is party to synthetic leasing programs for two of its major warehouses. The leases qualify for

operating lease accounting treatment under SFAS No. 13, “Accounting for Leases”. For additional information

on synthetic leases, refer to the Commitments, Contingencies and Off-Balance Sheet Arrangements note in the

Notes to Consolidated Financial Statements.

Total rent expense, net of sublease income, relating to all operating leases with terms greater than one year

was $119.7 million, $113.7 million and $100.7 million in fiscal 2004, 2003 and 2002, respectively.

F-25