Albertsons 2004 Annual Report Download - page 38

Download and view the complete annual report

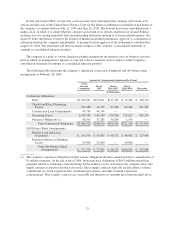

Please find page 38 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5) Includes 2,827,684 shares under the 1997 Stock Option Plan available for issuance in the form of restricted

stock, performance awards and other types of stock-based awards in addition to the granting of options,

warrants or stock appreciation rights and 73,500 shares under the Restricted Stock Plan available for

issuance as restricted stock.

6) Does not include outstanding options for 40,007 shares of common stock at a weighted average exercise

price of $25.82 per share that were assumed in connection with the merger of Richfood Holdings, Inc. into

the company effective August 31, 1999. No further awards will be made under this plan.

1997 Stock Plan. The Board of Directors adopted the 1997 Stock Plan on April 9, 1997 to provide for the

granting of non-qualified stock options, restoration options, stock appreciation rights, restricted stock, restricted

stock units and performance awards to key employees of the company or any of its subsidiaries. A total of

10,800,000 shares are authorized and may be issued as awards under the plan. The Board amended this plan

August 18, 1998, March 14, 2000, and April 10, 2002, and it will terminate on April 9, 2007.

All employees, consultants or independent contractors providing services to the company, other than

officers or directors of the company or any of its affiliates who are subject to Section 16 of the Securities

Exchange Act of 1934, are eligible to participate in the plan. The Board administers the plan and has discretion to

set the terms of all awards made under the plan, except as otherwise expressly provided in the plan. Options

granted under the plan may not have an exercise price less than 100 percent of the fair market value of the

company’s common stock on the date of the grant. Stock appreciation rights may not be granted at a price less

than 100 percent of the fair market value of the common stock on the date of the grant. Unless the Board

otherwise specifies, restricted stock and restricted stock units will be forfeited and reacquired by the company if

an employee is terminated. Performance awards granted under the plan may be payable in cash, shares, restricted

stock, other securities, other awards under the plan or other property when the participant achieves performance

goals set by the Board.

Restricted Stock Plan. The Board of Directors adopted the Restricted Stock Plan on April 10, 1991 to

provide for the granting of restricted stock to management employees of the company or any of its subsidiaries

who are not subject to the provisions of Section 16 of the Securities Exchange Act of 1934 at the time of an

award. The Board amended this plan on February 24, 2001 to increase the total shares available for issuance to

300,000. This plan has no expiration date. The chief executive officer administers this plan and may determine

who is eligible to participate in the plan, the number of shares to be covered by each award and the terms and

conditions of any award or agreement under the plan (including the forfeiture, transfer or other restrictions

relating to such award).

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The information called for by Item 13 is incorporated by reference to the Registrant’s definitive Proxy

Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection

with the Registrant’s 2004 Annual Meeting of Stockholders under the heading “Related Party Transactions,

Compensation Committee Interlocks and Insider Participation.”

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information called for by this Item 14 is incorporated by reference to the Registrant’s definitive Proxy

Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection

with the Registrant’s 2004 Annual Meeting of Stockholders under the heading “Independent Auditor’s Fees”.

33